LONDON–Sovereign wealth funds scaled back their investment in private markets last year and the main reason was a growing sense of real estate fatigue, according to a new report by the International Forum of Sovereign Wealth Funds.

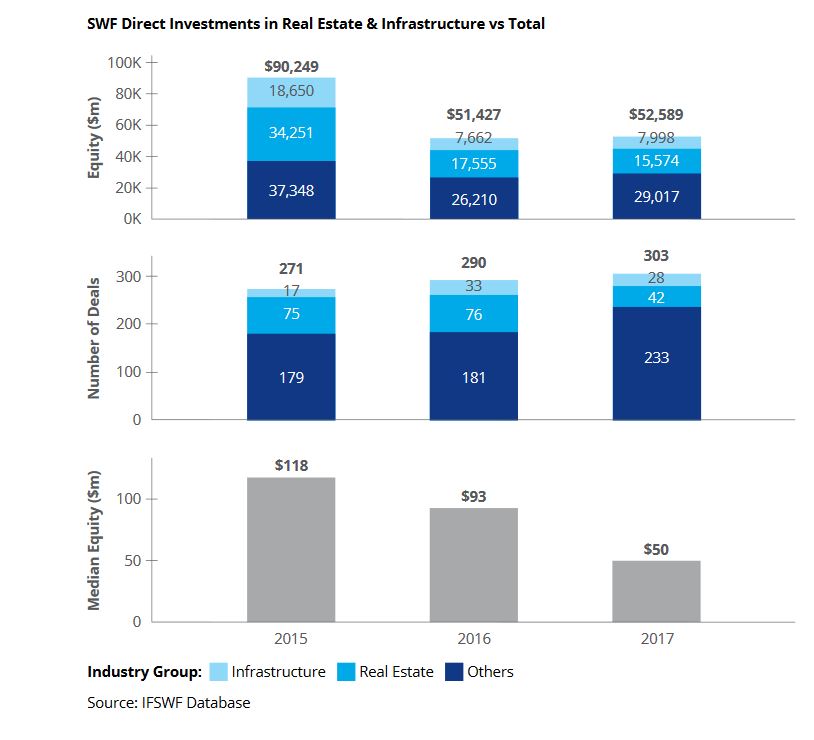

Last year direct real estate and infrastructure investments made by SWFs declined from a total of $25 billion in 2016 to $23.2 billion, according to the report. In the property sector, there was almost a 40% decrease in the number of investments in private markets between 2016 and 2017.

Most significantly, SWFs reduced their investment activity in commercial and office properties, a cornerstone of their CRE strategies. There were 17 of such deals out of 42 for the year, down from 25 out of 76 in 2016. SWFs' interest in luxury hotels, another key component of their CRE investments, has also declined over the last year to only five deals — a 75% reduction from the 18 made in 2015.

One reason for the slowdown in real estate investments is that some of the recently-established funds, such as Italy's CDP Equity, have a mandate to develop their home economies. But the primary reason for the decline: SWFs are finding it more difficult to buy properties as more institutional investors have recently entered the sector increasing competition for high-quality assets and pushing asset valuations higher.

The report does offer a bright note for the CRE industry: while overall volumes of SWF investment in real estate are lower, they remain interested in more attractively-priced investments further down the value chain, such as mixed use or residential rental properties. Such investments are attractive to SWFs because they allow them to tap into two trends: Baby Boomers looking to downsize and Millennials that have been priced out of the home ownership market.

Chart by the International Forum of Sovereign Wealth Funds.

Chart by the International Forum of Sovereign Wealth Funds.© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.