The nearly-decade long boom has changed and will continue to change Chicago's skyline, with new projects like the Vista Tower getting built in response to the intense demand.

The nearly-decade long boom has changed and will continue to change Chicago's skyline, with new projects like the Vista Tower getting built in response to the intense demand.

CHICAGO—There is little disagreement among Chicago-area real estate professionals that the regional market was consistently strong throughout the first half of 2018. However, according to a Mid-Year Chicago CRE Market Survey conducted by The Real Estate Center at DePaul University, there is no consensus about the future.

“There are many perspectives, and much to evaluate when considering the state of the commercial real estate markets in Chicago,” says Charles Wurtzebach, chair of the school's real estate department and director of the center. “CRE professionals with ties to The Real Estate Center generally see the glass as half full.”

According to Wurtzebach, job growth, organic business growth and outsiders' view of the value of Chicago real estate are all positive factors. In contrast, he noted rising interest rates; financial and political concerns at the city, county and state level; and the prospects for further increases in property taxes as factors keeping those thoughts in check.

Some of the key findings of the report include:

- 69.8% of DePaul related CRE professionals (members of its board and DePaul real estate alumni) say Chicago real estate markets have been consistently strong in 2018.

- Although 44.2% say their outlook for the second half of 2018 trends toward concerned, more than half have a positive outlook—30.8% remain bullish and 21.2% are optimistic.

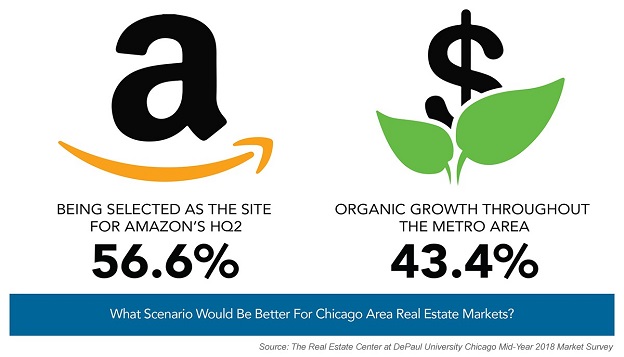

- Participants are almost evenly split when predicting which will be more beneficial for Chicago, the almost instantaneously created neighborhood associated with an Amazon HQ2 victory (56.6%) or the continuation of organic growth that has been taking place (43.4%).

- Almost 86.6% of those surveyed said the financial and related woes of Chicago and IL are having at least a modest level of significance on the city and state, but few see prices falling or investors walking away from deals as a result.

- Interest rates have not been having a significant impact on acquisition activity in Chicago, yet the interest rate climate is the leading national factor that causes participants the most concern.

CRE professionals are split over whether landing Amazon HQ2 would be better for the region over its expected organic growth.

CRE professionals are split over whether landing Amazon HQ2 would be better for the region over its expected organic growth.The center surveyed more than 3,000 of its sustaining sponsors and DREAA members. Follow-up interviews were conducted with select members of both groups for more in depth perspectives.

The sheer length of the current bull market, now almost one decade old, has many more concerned about 2018 than they were about 2017.

“Given the sustained bullishness of the Chicago marketplace, it is rational to think that some type of correction is in order,” says Brian Rogan, vice president, Associated Bank. But even though he believes prices may soften in the next year, he does not expect to see a major, across-the-board correction.

“Capital in the market is helping to push prices higher,” says Stephanie Matko, vice president, asset management, Pearlmark Real Estate Partners. “The unanswered question remains how many takers there will be at these higher prices.” She advised that anyone who can secure an off-market deal should act quickly as they are few and far between.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.