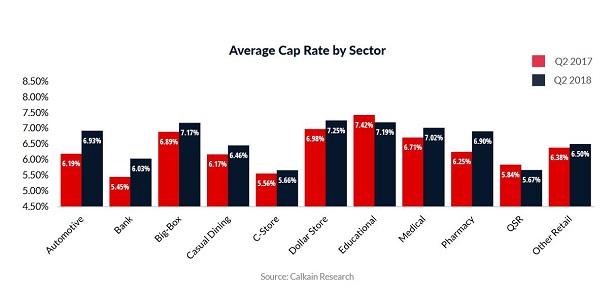

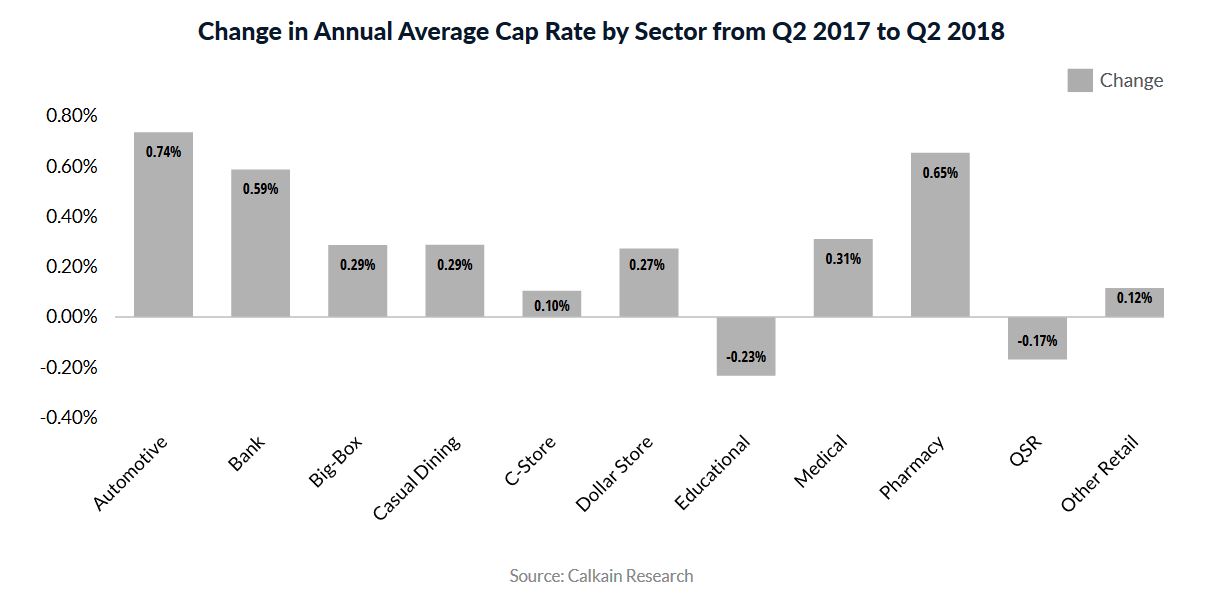

For the first half of this year, the average cap rate rose in nine out of the 11 net lease subsectors compared to the same period last year, according to the Calkain Cos.' Semi-Annual Net Lease Report.

Registering the largest increases were the automotive sector (from 6.19 to 6.93%) and the pharmacy sector (from 6.25 to 6.9%). Meanwhile, educational and quick service restaurants experienced cap rate declines. Following is a look at some of the drivers behind the performance in some of these sectors.

The Automotive Sector

Average cap rates in the automotive sector rose 74 basis points over the past year. Some reasons behind this increase, according to Calkain, include the possibility that auto sales have peaked for this cycle and that a meaningful share of recent purchasers are behind on their auto loan payments. “Elevated delinquency rates have a tendency to result in tighter lending standards, which in turn constrains new car purchases,” according to the report. “This could provide a boost to auto parts and auto service sectors in the near future and help lead to cap rates increasing at a slower pace.”

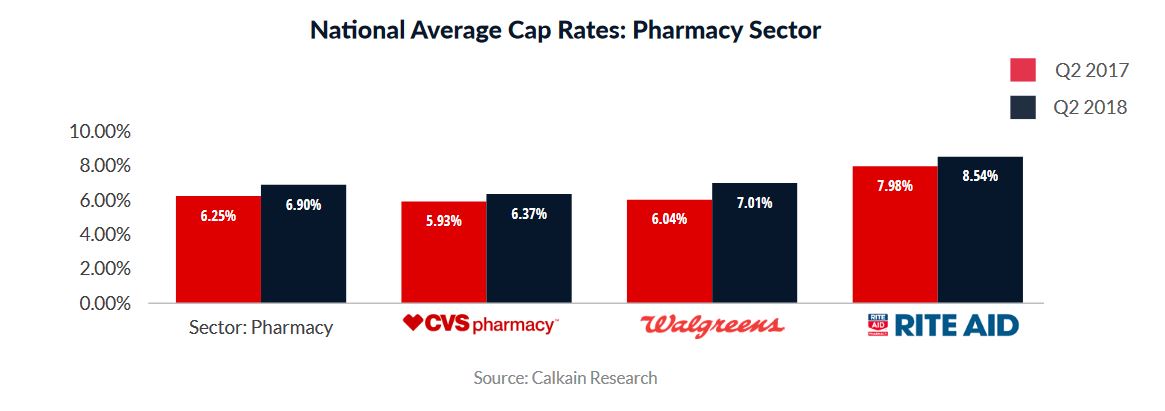

The Pharmacy Sector

Cap rates rose in the pharmacy sector by 65 basis points between Q2 2017 and Q2 2018. There were a number of industry event during this period, most recently the cancellation of Albertson's purchase of 2,500 Rite-Aid stores. An arguably more significant source of cap rate movement came from Amazon, Calkain Cos. wrote, when it acquired PillPack, an online pharmacy. “With online growing as a threat to traditional pharmacy operations, cap rates in this segment may continue to rise.”

The Big Box Sector

Average annual cap rates among Big Box properties rose 28 basis points to 7.1% during the first half of the year. However, the report said, this increase needs to be put into context: inflationary pressures are rising and consumer prices rose nearly 3% during the 12-month period. “Viewed from that perspective, the increase in cap rates is smaller than expected.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.