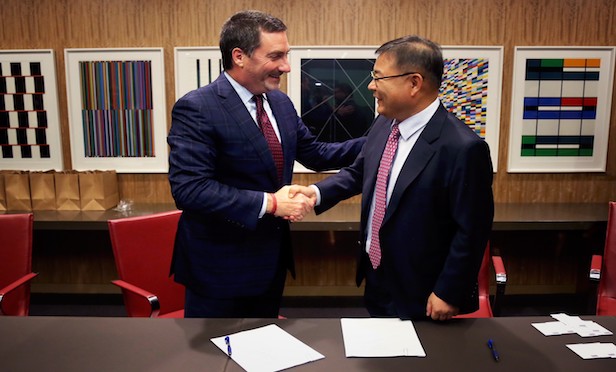

Avison Young CEO Mark Rose (left) welcomes Byoung Gon Choi, CEO of Mate Plus Advisors, to Avison Young.

Avison Young CEO Mark Rose (left) welcomes Byoung Gon Choi, CEO of Mate Plus Advisors, to Avison Young.

SEOUL, SOUTH KOREA—Commercial brokerage services firm Avison Young reports that is opening its first location in Asia in a big way here with 63 new members from South Korea-based commercial real estate firm Mate Plus Advisors Co. Ltd.

Byoung Gon Choi, former CEO of Seoul-based Mate Plus Advisors, becomes a principal of Avison Young's Seoul Operations and managing director of the new office. He will focus on expanding Avison Young's business-line coverage across South Korea, servicing new and existing clients, and managing the day-to-day operations of the office.

The new Seoul office is Toronto-based Avison Young's 85th office globally, and is an additional step in the firm's ongoing aggressive global growth and expansion strategy. Full operations in Seoul will begin on Nov. 1, 2018, company officials state.

Over the past 10 years, Avison Young has grown from 11 to, now, 85 offices in 76 markets and from 300 to more than 2,700 real estate professionals in Canada, the US, Mexico, Europe and Asia.

Mark E. Rose, chair and CEO of Avison Young, says, “We believe that Seoul is an underserved market that offers great potential for increased local, national and international investment sales and leasing activity. Seoul, which has a young, highly educated and tech-savvy workforce, is a gateway to China and the rest of Asia. The new Seoul office will also enhance our ability to facilitate multi-market transactions—and sets us up for further expansion within the Pacific Rim.”

Choi brings 34 years of commercial real estate experience in South Korea to Avison Young, and was also CEO of Mate Plus affiliate Mate Plus Advisors, which specializes in investment sales, retail, project management, asset management, leasing, research and advisory services; and CEO of Genstar, of which Mate Plus is a key affiliate.

Choi will work closely with Hiren Thakar, a principal of Avison Young and the firm's chief operations officer, international operations.

The expansion into South Korea follows Avison Young's announcement in July that Caisse de dépôt et placement du Québec, one of Canada's leading institutional fund managers, has made a $250-million preferred equity investment to accelerate Avison Young's strategic growth plan.

“The opening of our new Seoul office will allow us to capitalize further on CDPQ's investment in Avison Young's strategic initiatives,” Thakar says. “Our global team will continue to eye additional markets for expansion through the deployment of capital obtained via CDPQ's recent investment.”

Avison Young made its first investment under its strategic partnership with CDPQ by acquiring leading U.K. firm Wilkinson Williams LLP and opening a new office in London's West End on Aug. 1.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.