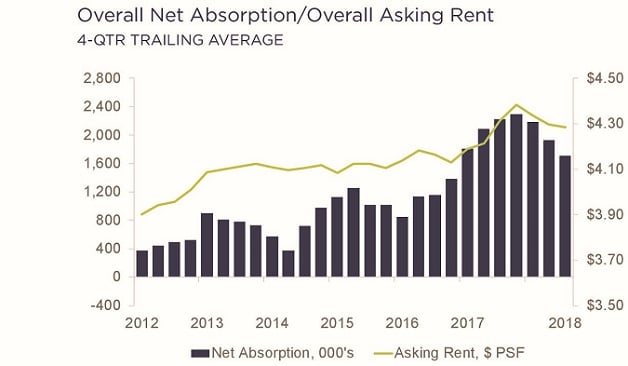

KANSAS CITY—It would have been difficult for the Kansas City industrial market to match this year the stratospheric levels of activity reached in 2017, but so far, things have kept humming along. The market absorbed another 4.7 million square feet in the first three quarters of 2018, and by the end of the year will almost achieve the second highest annual absorption total in the metro area's history, according to a report from Cushman & Wakefield.

The region's central location and solid transportation infrastructure has for years made it a hit with national and regional distributors, and the third quarter was no exception. It gained another major e-commerce tenant when Salt Lake City-based Overstock.com decided to occupy more than 500,000 square feet at BH Properties' 5300 Kansas Ave. in Kansas City, KS. The level of demand here was illustrated by the company's decision to go with an available class B warehouse space it could start using this month instead of competing for a newly constructed speculative facility.

Recommended For You

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.