This cycle, there has been substantial consolidation of student housing ownership across the country. According to Frederick W. Pierce, IV, of Pierce Education Properties, the consolidation—which has been a transition into more institutional ownership—has created a perfect storm for the market. As a result, student housing has matured into a more efficient asset class.

This cycle, there has been substantial consolidation of student housing ownership across the country. According to Frederick W. Pierce, IV, of Pierce Education Properties, the consolidation—which has been a transition into more institutional ownership—has created a perfect storm for the market. As a result, student housing has matured into a more efficient asset class.

“This consolidation in student housing ownership is largely due to the management-intensive nature of the asset class providing the opportunity for best-in-class operators to attract institutional capital that wants to invest with scale,” Pierce, president and CEO of Pierce Education Properties, tells GlobeSt.com. “It's a perfect storm, if you will, as experienced, best-in-class operators can deliver superior operating and investment performance, while their increasing economies of scale also reduce operating expenses on the margin for these growing companies.”

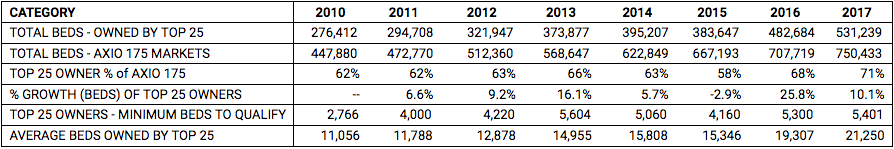

This has been a signature trend in the student housing market this cycle. “There has been tremendous consolidation in the student housing industry during the 2010 decade,” explains Pierce. “This is evidenced by the fact that the Top 25 Owners' holdings in the AXIO 175 markets has grown from 62% in 2010 to 71% in 2017. During this same period, the average number of beds owned by the Top 25 Owners has nearly doubled from 11,056 to 21,250 and the minimum beds necessary to qualify for the Top 25 has also nearly doubled from 2,766 to 5,401.”

The chart below show the steady increase in ownership since 2010 among the top players in this asset class.

The consolidation of ownership has helped to produce significant student housing activity this cycle. This activity, however, is in line with the strong student housing growth in the early 2000s. “Student housing emerged as a niche sector of commercial real estate in the mid-1990s as demographics, increased college-going rates and growing graduate programs produced 38% growth in higher education enrollments during the decade of the 2000s,” says Pierce. “At the same time as housing demand was increasing, so was student appetite for higher end product that resulted from a combination of an aging housing stock on and off campus and a proliferation of high school students having their own bedrooms, as opposed to share with a sibling like prior generations, at home.”

As a result, student housing has emerged as a top asset class for institutional investment. This has also propelled student housing into a new format with highly amenitized and well-designed spaces. “The result was the emergence of the purpose-built student housing sector, where private developers began building apartments off-campus that are leased by-the-bedroom and offer student oriented unit mixes, mostly three and four bedroom floor plans, single occupancy bedrooms and bathrooms and class-A amenities, like resort-style pools, 24/7 fitness centers, tanning beds, sand volleyball and basketball courts, business centers, game rooms, study rooms.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.