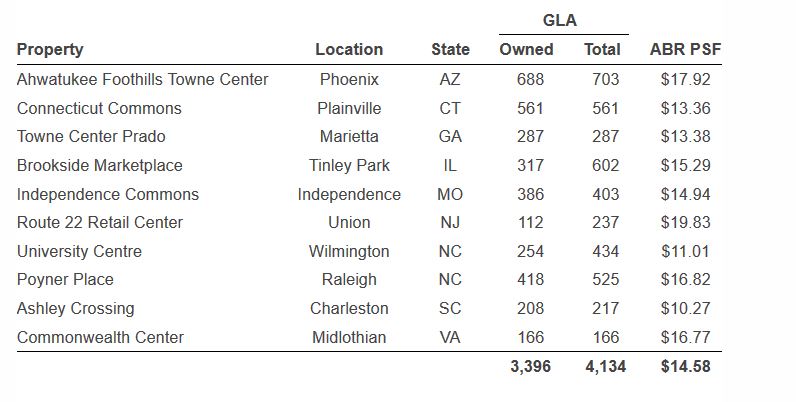

BEACHWOOD, OHIO–SITE Centers has closed a joint venture with two Chinese institutional investors in which a 10-property portfolio has been recapitalized at approximately $607 million. SITE Centers will retain a 20% stake in the joint venture and receive management fees. The joint venture has also entered into a $364 million mortgage.

Recommended For You

SITE Centers plans to use its new liquidity to expand its opportunistic investment program, to fund its redevelopment pipeline and to repurchase its common shares. Net proceeds will also be used to repay $95 million of mortgage debt maturing in first quarter 2019 and up to $400 million of unsecured debt.

SITE Centers expects it will extend the joint venture beyond this initial investment, said David Lukes, President and CEO.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.