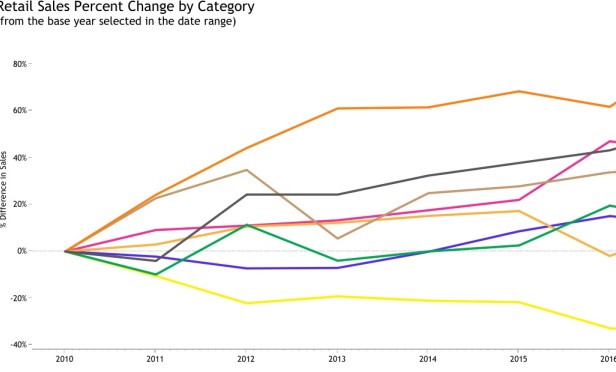

Clothing/department stores have recorded the largest gains, followed by building/garden supply.

Clothing/department stores have recorded the largest gains, followed by building/garden supply.

SEATTLE—Downtown leads the region in retail sales and its real estate market is one of the hottest in the country. In fact, its taxable retail sales nearly match the retail earnings of the entire city of Tacoma.

During the past seven years, the retail vacancy rate has hovered between 3 and 4%, and the average time from construction completion to leasing fell from more than a year to only seven months, according to CoStar. Moreover, with dozens of leasing deals and more than 150,000 square feet of new retail leases in 2017, downtown lease rates remain strong.

Each year, the Downtown Seattle Association requests custom taxable retail sales data from the Washington State Department of Revenue in order to identify trends in downtown and other area geographies. The highest sales by category (in order) are clothing/department stores (noted by an orange line), building/garden supply, health/personal care, electronics, food and beverage, hobby items, furniture and gifts/miscellaneous.

Any business with multiple locations in Seattle have sales allocated based on the number of locations and the number of employees at those locations. For business locations with higher than average sales for that company, this will lead to an underestimate in the total for that business location. Businesses located outside Seattle but doing business in Seattle are allocated based on multiple factors, including population, area and business activity.

In addition to this hot downtown retail climate, retailers may find added opportunities to capture holiday shoppers, according to survey data from Numerator's InfoScout OmniPanel. The survey indicates that most shoppers will finish shopping during this month while about half will finish shopping in early December.

“In a survey of over 500 members of Numerator's InfoScout OmniPanel, 75% said they will finish their Christmas shopping in December and 20% will wait until the last minute before Christmas,” Ryne Misso, numerator's director of marketing, tells GlobeSt.com. “This is yet another testament to the lengthening of the season both before and after Black Friday weekend, as consumers continue to reshape holiday shopping as we used to know it.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.