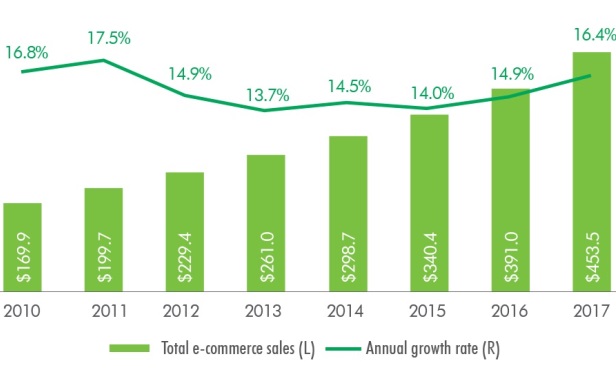

SAN JOSE—E-commerce accounts for almost 9% of total US retail sales today and has been growing nearly three times faster than brick-and-mortar sales since 2010, according to CBRE research. E-commerce sales totaled $453.5 billion in 2017, growing at an average of 15% annually since 2010, according to the US Census Bureau.

E-commerce is defined as sales of goods and services through digital channels (Internet, mobile device, etc.). E-commerce sales include Internet sales of pure-play e-tailers (retailers that operate solely online) and the online sales of brick-and-mortar brands (i.e., a purchase made through a physical store brand's website). Not included in these e-commerce sales is revenue from online travel services, financial brokers and ticket sales agencies.

Recommended For You

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content