In its December 2018 multifamily report, Yardi Matrix theorizes that the multifamily asset class could be on a trajectory much like hotels, which have had nine consecutive years of above-trend revenue growth. “Hotels benefit from business profitability and travel, but also from lifestyle changes that lead individuals to spend more on experiences,” the report said.

Unabated Demand

So it goes with the multifamily sector, which just wrapped up its eighth straight year of robust performance. It is an impressive record but it also leads to the question of just how long this cycle can go. One reason Yardi Matrix thinks it still has legs is the unabated demand for apartments, which is partly influenced by changing lifestyle preferences.

There are other factors too of course: student loan debt that limits first-time homebuyers and retirees downsizing and moving into rentals are also driving demand. Overall, since the beginning of the run in 2011, some 8.9 million households have formed in the US, an annual average of 1.1 million.

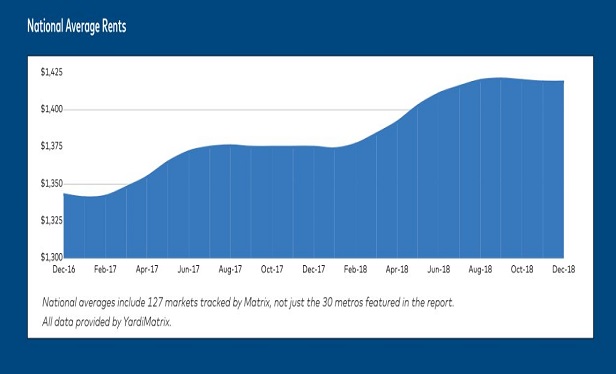

The end result has been national rents that have increased by 31% since January 2011, according to Yardi Matrix. Annual rent growth has been at least 2.9% in every year except for 2017. Rent growth has topped 3% in six of the last eight years.

As for 2018, it was a solid year for the multifamily sector, and the 3.2% rent growth slightly exceeded going-in expectations. Las Vegas (7.3%), Phoenix (6.5%) and the Inland Empire (5.5%) are the top 3 growth metros, highlighting a trend of outperformance among secondary markets.

Projections for 2019

Rent growth in 2019 is expected be led again by metros in the Southwest, West and South regions. “Despite the recent volatility in the financial markets, we foresee more of the same in 2019, with strong demand producing rent growth just shy of 3% nationally,” Yardi Matrix writes in its report.

On the other end of the spectrum, Dallas, Denver and Nashville — basically submarkets in the urban cores of secondary markets — are likely to see growth stymied in the short term. That is because of the supply pipeline, with the market about to embark on another year of about 300,000 deliveries. Indeed the supply is expected to be the biggest obstacle to rent growth overall.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.