ORLANDO, FL—The latest data from the residential home sales market in Florida was a mixed bag with sales falling more than 6% in January, but for-sale inventory ratcheting higher, which could help add more affordable properties to the market going forward.

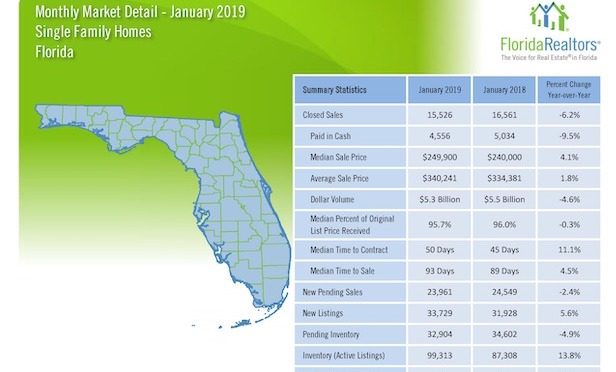

Sales of single-family homes statewide totaled 15,526 last month, down 6.2% compared to January 2018, according to Florida Realtors, which is based in Orlando. Statewide closed sales of condominiums last month totaled 6,739, down 10.9% compared to a year ago.

The Realtor organization blamed buyer uncertainty caused by the partial federal government shutdown, instability in the stock market and the specter of rising mortgage interest rates as the root causes of the lower sales volume in January.

Statewide median sales prices for both single-family homes and condo-townhouse properties increased year-over-year for the 85th month-in-a-row in January.

The statewide median sales price for single-family existing homes last month was $249,900, up 4.1% from January 2018, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations. Last month's statewide median price for condo-townhouse units was $182,500, which was 2.8% higher than the same period a year ago.

The dollar volume of single-family home sales statewide totaled $5.3 billion in January, down 4.6% from a year ago.

“As the new year gets underway, more new listings and gains in inventory (active listings) are positive signs for potential homebuyers in Florida,” says 2019 Florida Realtors President Eric Sain, a Realtor and district sales manager with Illustrated Properties of Palm Beach. “Having more homes available for sale in many local markets may start to ease some of the affordability constraints we've been seeing for a long time.”

He notes that new listings for existing single-family homes rose 5.6% in January 2019 as compared to a year ago and new listings for condo-townhouse properties increased 2.5% during that same period.

Florida Realtors Chief Economist Dr. Brad O'Connor says that at the end of January there were 13.8% more single-family homes listed for in Florida as compared to a year ago. The inventory level at the end of January for single-family homes is at its highest level since March of 2015.

“The ongoing rise in inventory continues to be rather broad-based – among the price tiers tracked by Florida Realtors, single-family inventory only fell among the small segment of homes priced below $100,000. This is a significant change from a year ago, when much of the state's mid-tier inventory was still declining,” O'Connor notes.

A deeper dive into the Florida Realtors data for January showed that sales in a majority of major markets in the Sunshine State were lower, including Miami (-15.4%); Tampa-St. Petersburg-Clearwater (-4.2%); Deltona-Daytona Beach-Ormond Beach (-5.3%) and Orlando-Kissimmee-Sanford (-4.0%).

Some of the few exceptions to the rule included Jacksonville, which saw a 5.3% spike in sales, Naples-Immokalee-Marco Island, which enjoyed a 10.5% increase in sales and Panama City, which posted sales that were 27.1% higher than in January 2018.

Join the 17th Annual GlobeSt Net Lease Conference (formerly a RealShare event) on April 3 & 4 in NYC alongside the industry's most influential and knowledgeable real estate executives from the net lease sector. Click here to register and view the agenda.

Join the GlobeSt.com Women of Influence 2019 conference July 10th and 11th in Broomfield, CO, which celebrates the women who drive the commercial real estate industry forward. The event will address the critical role of women in the CRE business. Click here to register and view the agenda.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.