The vacancy rate continues to plummet, especially in San Francisco, due to tech tenants' demand for more space.

The vacancy rate continues to plummet, especially in San Francisco, due to tech tenants' demand for more space.

SAN FRANCISCO—To be sure, tech industry growth demand and dwindling supply have contributed to a citywide surge in office leasing activity. The last time this happened was two decades ago when demand represented 113% of available space, according to a recent report by CBRE.

In fact, office tenant demand relative to available supply has reached its highest level since 1999, the midway point in the dot com boom. The total square footage of tenants in the market has increased to 6.8 million square feet, equal to the level of existing supply.

This limited available space, rising demand from growing tech companies and a stalled supply pipeline all suggest higher rents ahead.

“Demand relative to available supply is just another measure of the health of the market and we have not seen demand surpass available supply in the past two decades,” Lexi Russell, associate director of research with CBRE in San Francisco, tells GlobeSt.com. “Tenant demand has been elevated during the past two years, but significant large deals and pre-commitment of new construction has further limited available supply. With no new space coming available in the next few years, market fundamentals should remain skewed and suggest a further increase in rents.”

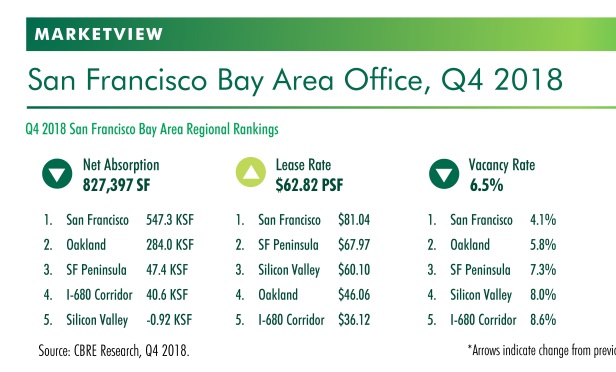

In 2018, there was 12 million square feet leased, along with 21 deals of 100,000 square feet or more, 3.9 million square feet of positive net absorption and 11% growth in average asking rents to $81.04, which were all new record highs, according to CBRE's fourth quarter office report. Critically low office space supply were both the result of and reason for these surges as expanding tech firms seek to secure future growth paths.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.