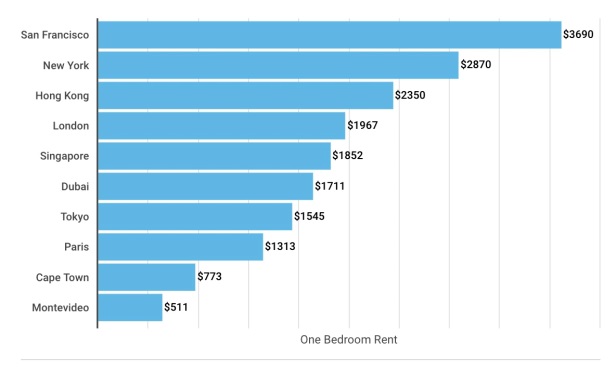

One-bedroom rent reached a record $3,690 in March, making San Francisco the world's priciest city.

One-bedroom rent reached a record $3,690 in March, making San Francisco the world's priciest city.

SAN FRANCISCO—As tech seeks creative opportunities in an increasingly tighter market on the precipice of the IPO boom, office demand continues to outpace supply. This has resulted in a 30-basis point decrease in overall availability quarter-over-quarter to 7.9%, according to Savills research. This marks a 240-basis-point decline for the year.

Moreover, this declining office availability is putting upward pressure on asking rents, which ended the first quarter at $74.67 per square foot for all classes. Class-A rents climbed to an average of $77.41 per square foot, increasing by 2.1% from the end of last year alone, says Savills.

New supply is limited with only a handful of projects underway and all new product completing this year has already been pre-leased to-date. Meanwhile, the technology, advertising, media and information/TAMI and co-working sectors continue to dominate the war for space.

Co-working providers WeWork, HQ by WeWork and Knotel accounted for five of the 10 largest leases in San Francisco during the first quarter. These leases alone added 260,000 square feet to an already robust co-working inventory.

Even still, tech companies and the TAMI sector still account for the bulk of leasing activity in the market. This quarter, Google took an additional 189,000 square feet at One Maritime Plaza, mere weeks after taking 300,000 square feet at One Market, backfilling Salesforce's prior headquarters. Asana snapped up the last significant block of space in the construction pipeline, taking all 272,000 square feet available at 633 Folsom St.

This supply demand imbalance is pushing tenants to look well into the future to stake claims on new space. Both Salesforce and Pinterest have recently secured buildings that have not even received entitlements to begin construction yet, with future IPO candidate, Pinterest, committing to 490,000 square feet at 88 Bluxome St. this quarter.

As the Bay Area braces for the impending IPO onslaught, San Francisco multifamily rent also continues to skyrocket. Zumper's March rent report revealed that San Francisco one-bedroom rent had reached an all-time high of $3,690.

“Zumper data just showed a new peak for San Francisco one-bedroom rental prices in March 2019, led by increases in the multifamily segment,” Anthemos Georgiades, CEO of Zumper, tells GlobeSt.com. “Because, for various reasons, some geographical, some political, supply continues to come onto the market at a snail's pace, the continued net migration to the Bay Area for technology jobs coupled with the new liquidity from IPOs may continue to push up the luxury end of the San Francisco market, driving up the overall median up too.”

That record-high rental price tag makes San Francisco home to the most expensive rent in the world by a hefty margin. In fact, in study after study, San Francisco consistently comes out on top as the priciest US city.

“The biggest impact from the imminent 2019 IPOs will be felt on the luxury end of the residential rental market, with the most likely ZIP codes affected being those within a short commute from the new public companies' headquarters such as Uber and Airbnb,” Georgiades tells GlobeSt.com. “Zumper can already see upward price pressure in high-end multifamily developments in those micro-neighborhoods, and 10%-plus price upticks there would not be unheard of. The long tail in outer neighborhoods is unlikely to see the same dramatic upward pressure.”

Outside of the United States, the next priciest rent on Zumper's list was Hong Kong's, which was still more than $1,200 cheaper than San Francisco's one-bedroom rent. London's one-bedroom rent nearly hit $2,000, while Paris' one-bedroom rent nested at around $1,300. Meanwhile, Cape Town in South Africa and Montevideo in South America had rents below the $1,000 threshold, according to Numbeo and Utinokati.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.