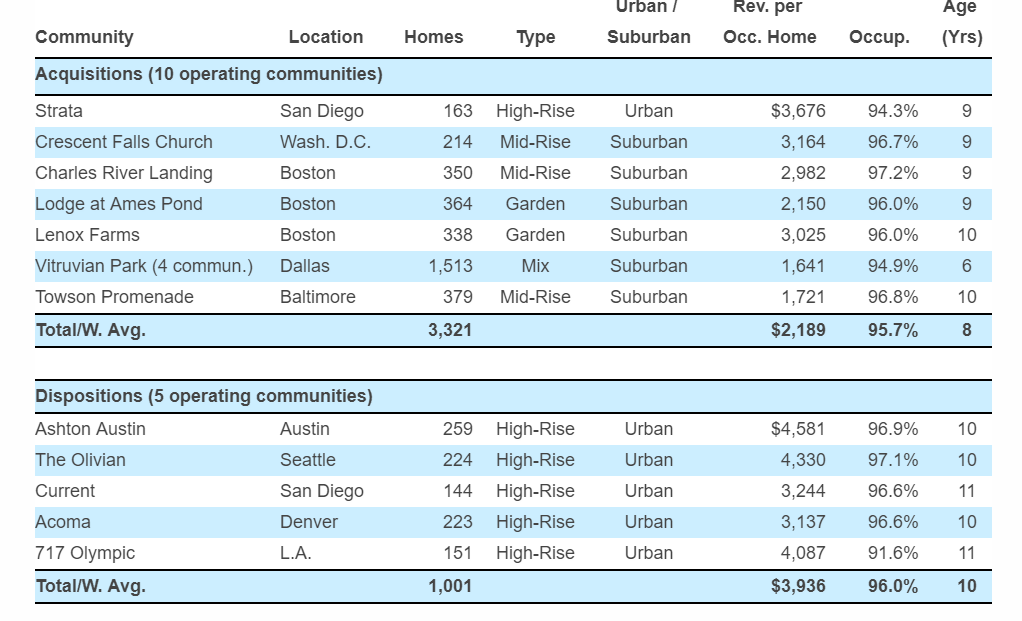

DENVER—UDR and MetLife Investment Management have entered into an agreement in which 10 properties as well as some land sites at Vitruvian Park and a development project will be folded into an existing JV between the two companies. In addition, MetLife will buy out 5 properties already owned by the JV.

The JV will acquire a 50% stake in 10 properties, one community under development and four development land sites valued at $1.1 billion, or $557 million for UDR’s share. The JV is also selling a 50% stake in five communities valued at $645 million or $323 million at UDR’s share to MetLife Investment Management.

The transaction is expected to close during the fourth quarter, subject to customary closing conditions and closing price adjustments.

UDR CEO Tom Toomey noted that the acquired communities are primarily located in markets targeted for expansion, have operational upside and will improve the portfolio’s diversity.

Once the deal closes, the UDR/MetLife Investment Management JV will consist of 13 communities located in California, Boston, MA, New York, NY, and Philadelphia, PA.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.