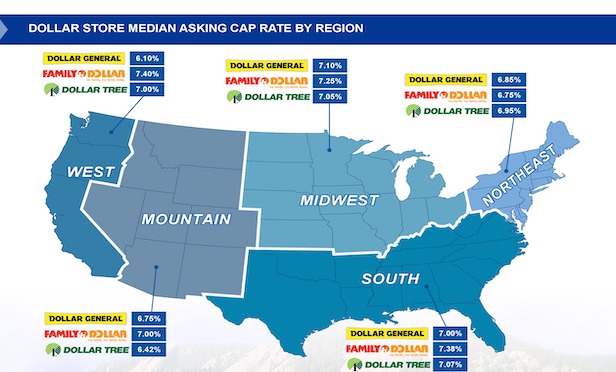

WILMETTE, IL—The cap rate for dollar store sector properties (primarily Dollar General, Dollar Tree and Family Dollar) was flat at an average of 7.1% at the end of the second quarter of this year.

According to a report released by The Boulder Group of Wilmette, IL, the average cap rate was unchanged as compared to a year earlier, although the cap rate performances for the respective dollar store retailers were mixed. Cap rates for Dollar General were constant at 7.05%. Family Dollar cap rates decreased by six basis points to 7.25% and Dollar Tree cap rates increased by eight basis points to 7.10% in the second quarter of 2019.

Dollar Tree acquired Family Dollar for $8.5 billion in 2015. Earlier this year, Family Dollar announced plans to close 400 stores nationwide. According to the report, Dollar General operates 15,472 locations, while Dollar Tree and Family Dollar operate a combined 15,237 locations.

John Feeney, SVP of The Boulder Group and author of the Dollar Store Research Report, said, “Single tenant net lease dollar stores continue to be in demand with private and 1031 exchange buyers. These assets offer investors long-term leases to investment grade tenants at investment yields above the net lease retail sector average (6.23%). In the second quarter of 2019, dollar store properties were priced at an 87-basis point discount to the net lease retail market due to their typical locations in tertiary markets.”

Feeney added that the dollar store sector continues to expand with thousands of new locations in the pipeline. The report states that in 2019 Dollar General alone plans to open approximately 1,000 locations, while the dollar store sector has a pipeline of approximately 24,000 new locations planned for the future.

Dollar stores in more populated markets demand premium pricing due to their stronger real estate fundamentals and greater backfill potential, the report stated. In the second quarter of this year, Dollar General properties with populations in excess of 35,000 within five miles comprised only 20% of the Dollar General supply on the market. These properties commanded a 6.5% cap rate, which represented a 55-basis point premium over all other Dollar General properties.

Feeney notes that investment activity in the net lease dollar store sector will remain active as investors continue to take advantage of the higher yields the asset class generates when compared to other net lease sectors with low absolute price points.

With the recent rate cut from the Federal Reserve and an additional cut expected in 2019, financing will be very attractive for the net lease dollar store asset class.

“With a strong development pipeline due to dollar store expansion plans, supply will remain saturated with long term leased properties,” Feeney said. “The expectation is that there will be increasing demand for this asset class within larger markets. New construction assets will also be in demand as investors look to take advantage of the full lease term for cash flow.”

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.