Photo by Shutterstock.

Photo by Shutterstock.➤➤ Join the GlobeSt.APARTMENTS (formerly RealShare) conference October 29-30 in Los Angeles. The event will analyze the opportunity in the emerging trends and conditions of the multifamily market. Don't miss out on joining the 1000+ of the industry's top owners, investors, developers, brokers and financiers as they gather for THE MULTIFAMILY EVENT OF THE YEAR! Click here to register and view the agenda.

NEW YORK—Rent control has become a highly-charged issue in many cities and states. Oregon and New York have passed measures placing caps on rent increases; California is considering a similar measure to name a few examples.

Indeed, housing affordability is a serious issue but rent control may not be the best way to address this concern, concludes an analysis by Real Capital Analytics. Already, writes Jim Costello, new demands for rent control are repricing assets in a way that may lead to loan defaults and lower housing availability over the long run. Namely, he writes, "Investors and lenders are repricing assets in markets where rent control exists or is being introduced."

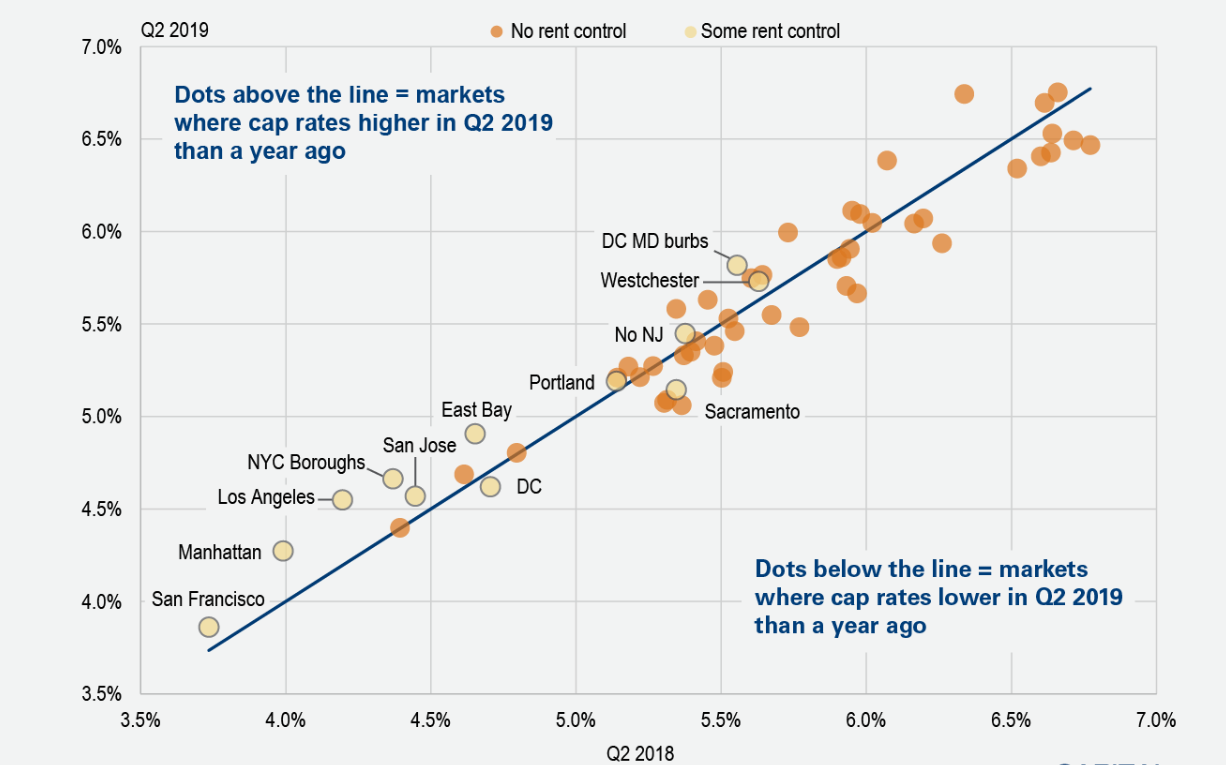

Costello examined 58 US markets and found that in the 10 out of the 12 cities where some form of rent control has been introduced, apartment cap rates have increased over the last year: an 83% share. In the remaining markets, only 19 out of 46 markets have seen cap rate increases: a 41% share.

Obviously there are other factors helping to push up these cap rates, he writes. "The increase is mostly focused on the more expensive markets in the US where cap rates are structurally lower, and as investors worry about how much cap rates will move up when interest rates do again someday, some of the repricing may be a function of investors unloading a portion of that rate uncertainty."

That said, other factors suggest that a good portion of the move is due to the capital restrictions that come with the imposition of rent control, he continues, pointing to a Wall Street Journal article that reported how the stock price of banks lending in the New York apartment market were savaged when stricter rent controls were introduced earlier this year. "Some of those losses have been reversed since, but a lender with exposure to New York apartments is still in an awful situation where the assets for which they have loans face higher credit risks moving forward," Costello writes.

Thus a less-than-virtuous circle is introduced. Income cannot keep up with the previous underwriting so lenders will need to scale back what they can finance. Investors looking at the market with more limited, and therefore more expensive, financing options, cannot pay as much for an investment which will help to suppress prices. That price suppression comes back around to the lenders then being even less willing to extend credit.

Costello thinks that, given the run-up in apartment asset values in recent years, the increase in cap rates is not likely enough to drive a wave of loan defaults. But if it continues, he warns, fewer finance options will lead investors to limit capex, withdraw units, and/or deliver even fewer units of new construction.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.