PINECREST, FL—In what is still a supply constrained market, despite the continued instability of the retail sector, the vacancy rate for retail space in Miami-Dade County remained relatively flat in the third quarter.

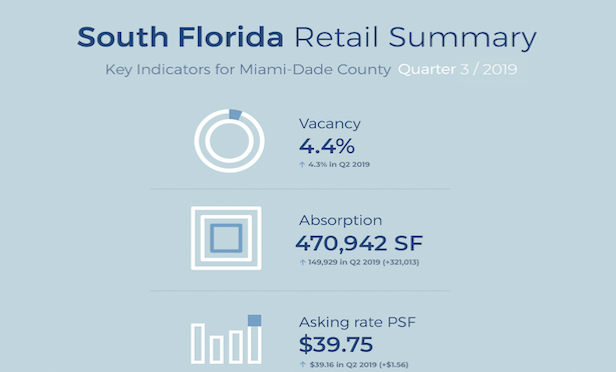

MMG Equity Partners, in its third quarter report on the South Florid retail market, states that the third quarter vacancy rate for retail space rose by 0.1% from the second quarter to 4.4%.

The asking rental rate rose $0.56-per-square-foot to an average of $39.75-per-square-foot from the second quarter. In the past year, MMG Equity notes that the average asking rental rate has risen $4.21-per-square-foot from the $35.54-per-square-foot registered in the third quarter of last year.

The retail absorption rate moved up from +149,929 square feet in the second quarter of 2019 to +470,942 square feet in the third quarter, a +321,013-square-foot change quarter-to-quarter.

"On a macro level, South Florida remains a largely supply constrained market due to the scarcity of available land. Although there has been a softening in rates of non-core product within the market, all properties are still trading at a relatively lower rate than other Florida markets," says Marcos Puente, director of acquisitions, MMG Equity Partners. "All new supply that has come to market by means of retailers shuttering has quickly been gobbled up by the development community to either backfill the former retail spaces with new stores, or be repurposed to a new use."

The largest retail sale transaction in the third quarter was the $33.1-million sale 509 Collins Ave. in Miami Beach. The 22,875-square-foot building acquired by Allied Partners, Inc. traded for approximately $1,445-a-square-foot.

MMG Equity Partners reports that at the end of the third quarter there were 52 retail properties under construction in the Miami market representing 2.8 million square feet of new product.

The largest project under construction, which is scheduled to be delivered in the fourth quarter of this year is the 800,000-square-foot Warren Henry Auto Group project at 2300 NE 151 St. being developed by Turnberry Associates.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.