Demand jumped for Oakland and Scottsdale due to the high rents of San Francisco and Phoenix.

Demand jumped for Oakland and Scottsdale due to the high rents of San Francisco and Phoenix.

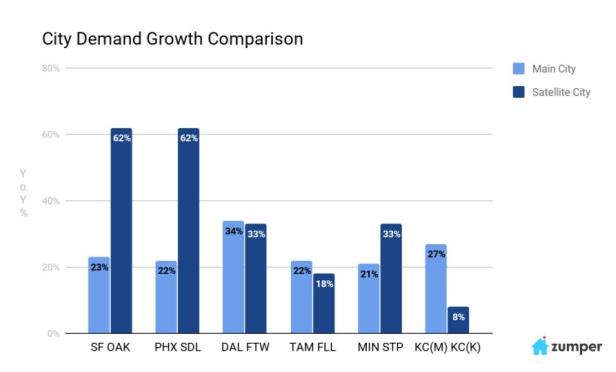

SAN FRANCISCO—When a major US city gets too expensive or corresponding satellite cities start sprouting new amenities, demand and price growth in those satellite cities can actually outpace that of the core cities. Zumper used its data to identify major metropolitan areas that retained popularity last year and which satellite cities stole the spotlight.

"Our data shows that renters are starting to get more and more interested in renting in satellite cities to avoid sky-high rents in city centers like San Francisco," Crystal Chen, marketing manager with Zumper, tells GlobeSt.com. "This is not surprising, but what is surprising is how quickly demand is rising year-over-year."

Satellite Cities with Larger Demand Growth:

Oakland, CA posted a large 62% increase in demand from 2018 to 2019, while San Francisco's demand grew 23%. With one-bedroom rent in San Francisco hovering around the $3,500 threshold, many renters are being priced out of the nation's most expensive city and are turning to more affordable satellite cities such as Oakland for lower living expenses.

Scottsdale, AZ, similar to Oakland, saw a year-over-year demand bump of 62%, shadowing Phoenix's 22% growth. Scottsdale has become a very popular city, offering a strong job market, affordability in terms of cost of living and status as one of America's top college towns.

St. Paul, MN's 33% year-over-year demand growth rate outpaced Minneapolis' 21%, though both cities experienced a growing demand from thriving job markets and newly constructed housing becoming more readily available. Demand can be attributed to St. Paul's median one-bedroom rent being somewhat less expensive than Minneapolis'.

Main Cities With Larger Demand Growth:

Dallas' 34% year-over-year demand growth rate inched out Fort Worth's by 1%. As the DFW metro area has one of the nation's fastest growing populations, the demand for housing has remained high.

Notably, all satellite cities had larger year-over-year rental growth rates than respective main cities and not every satellite city had less expensive rents. Oakland's year-over-year rent price growth rate outpaced San Francisco's by three times. Similarly, Scottsdale rental rates grew twice as fast as Phoenix's. Dallas and Minneapolis rents both decreased in the past year, down 4% and 2% respectively, while corresponding satellite cities, Fort Worth and St. Paul, had growth rates both up 4%.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.