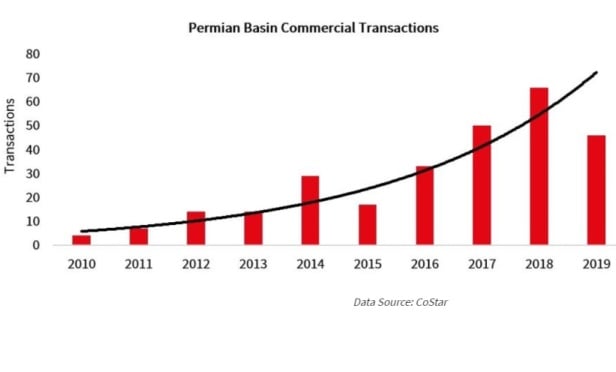

Permian Basin CRE transactions mostly increased from 2010 to 2018 but not 2019 (credit: CoStar).

Permian Basin CRE transactions mostly increased from 2010 to 2018 but not 2019 (credit: CoStar).

HOUSTON—Approximately half of US reserves are located in the Permian Basin, according to the Energy Information Administration. This basin has the lowest break-even price of any US basin for new wells, according to the Dallas Fed. And, every major US oil company has heavily invested in the area, indicating long-term plans to remain.

But, does this tell the whole story for the oil and gas industry?

"The Permian has been active for over 100 years with its booms and busts, but a new chapter began about 2008 when hydraulic fracturing revolutionized the industry," says Joel St. John, JLL vice president.

"Now, over the last dozen years, the oil and gas industry has reached maturity in the Permian. This is important to understand because the oil and gas industry is the main economic driver in the region. We can see this through consolidation of oil and gas companies in the marketplace. If you are new, trying to keep up with the mergers and acquisitions is a job in itself."

This consolidation reflects the region's maturity as more experienced and deeply capitalized firms grow and influence the market. New oilfield technology has been implemented, which is evident in rig productivity. Engineers and service providers have more experience. Of course, technology in the upstream and downstream market will continue to evolve, but more slowly and with less impact than it has in the past, St. John points out.

"For the most part, the land rush is gone," he says. "All 'the majors' have purchased institutional-sized positions in the market, creating super blocs of contiguous acreage. This allows for highly efficient execution and a more scalable approach for upstream exploration and production companies."

Economically speaking, the market has now moved into the long-run cycle. According to Hart Energy, capital investment by exploration and production companies will top $40 billion by 2021. Capital-intensive projects such as a leading refiner almost doubling its refining capacity in Beaumont is a good example. Five new oil pipelines are set to open in the Permian through 2021, minimizing the gap between production and transport capacity. Capital has been spent and now the marketplace is more competitive because there's more infrastructure and suppliers. This capital is now out competing for clients in the marketplace.

"Cumulatively, this illustrates that the oil and gas industry has matured and stabilized in the Permian Basin," St. John observes. "The influx of institutional investment, the consolidation of O&G companies and the technological change benefiting operators illustrate that the firework boom and bust cycle of past will likely fade to sparklers in the future."

Around 2008, the Permian was being developed by wealthy ranchers and local real estate developers. There were simply not enough industrial buildings and industrial yards to meet the demands of E&Ps, welders, truckers and the like. Price was irrelevant. Now the market has had more than a decade to catch up.

"Originally, you had ranchers becoming real estate developers. A perfect example is the Taylor Family with the Pecos Industrial Park and Wolfcamp Yards Industrial Park," St. John says. "Then you had developers that specifically serve the oil and gas industry come to the area. Think ERP, Formation Real Estate and Lunnen Real Estate Services. Then you had your typical real estate developers that look for under supply. First Keystone, Brigham Development, PetroPlex Properties and Caleb Matott may come to mind. All are now present in the Permian. This means there are more players, more supply and more capital. More capital means more investors. Real estate investors don't want 4% cap rates for industrial investments like they're going to get in Los Angeles. So they look for underserved markets or undercapitalized markets like Pecos."

The Permian commercial real estate market hasn't reached maturity, but it's close, St. John cautions. This is causing a real estate conundrum for experienced investors who only know about the West Texas wildcatters of yesterday. They have not looked at the supply of oil in the Permian compared to other basins, the billions of dollars invested in land, pipelines and refineries, the changes in technology or observed the consolidation of the industry, he says.

"Interest remains high because it's the Permian, but those who are interested now have longer-term expectations than those who've come before them," St. John tells GlobeSt.com. "The Permian was the domain of wildcatters looking to strike it rich. Now it's characterized by institutional investors and operators with a long-term investment plan. That's what's changed over the last decade: long-term institutional investment with high levels of capital investment driving down operating cost. It's changing the economics."

What do these changes mean for the commercial real estate industry? In short, CRE fundamentals are shifting. First, risk has changed. The major booms and busts of the past are not going to be the playbook of the future.

"Even as rig count fluctuates, there will be demand for petroleum products and oilfield services on existing wells, pad sites, frac pits and water wells," St. John says. "With so much production having occurred and now with a long-run economic phase in motion, demand will continue to grow at above average rates, but with more muted highs and lows."

Second, Permian commercial real estate is in relative balance. For the most part, supply has had time to catch up with demand.

"But companies are continuing to request buildings from landlords or move from yards to buildings because they realize they're going to be here," St. John says. "Even despite low WTI prices, they're going to be here. And as we have observed, most will continue to grow. And, as oil prices fluctuate, more providers and more players will likely come to the Permian because of its stability compared to other basin markets."

Third, risk is being priced differently by long-term investors. Capitalization rates or how capital and cash flow risk is priced in real estate are declining. Why? Because risk has declined. This means that the price of real estate goes up even as rents stay the same.

Fourth, leases are written differently.

"In the not-so-distant past, deals were made on a handshake," St. John recalls. "However, market participants continue to become more knowledgeable in how they structure their deals. This is due at least in part to brokers who have come to West Texas to facilitate transactions for landlords, tenants and investors."

Finally, more educated investors in a balanced market creates different expectations for real estate. The expected returns shift based on how investors purchase a property and how long they plan to hold it. Initial investors operated from a short-term supply mindset but new investors are operating from a long-term mindset, St. John points out.

So what does this mean for Permian real estate investors today? As risk decreases, and supply and demand continue to be balanced, prices and values will increase. This is going to be a trend during the next decade.

"The risk will be oversupply by developers who do not watch market vacancy rates," St. John cautions. "Well-built, well-located properties with good tenants will command a premium as they do in all mature markets. Tenanted properties become more valuable than vacant buildings. In the early 2010s, you wanted to own an industrial yard or vacant building because they were so undersupplied. Now there is supply, and the key is keeping your tenants and continuing to add tenants as the overall market grows."

On the residential front, housing is continuing to adjust. Temporary to permanent housing will be the norm. There will likely be fewer RV parks and instead more apartments and hotels.

Residential sales volume and sale prices have continued to increase during the last decade and single-family housing will continue to increase. This will be a slow, but likely trend.

"The wild card is utilization of natural gas. Natural gas is one of the byproducts you get when you drill for oil," St. John says. "There's such a supply of natural gas around the world that drillers cannot get it to market for a profit. Once car manufacturers and other industries begin to utilize this low cost, high supply energy source, it will dramatically strengthen economics in the Permian, as well as every other basin around the world."

Outside of commercial real estate, the labor market is catching up and continuing to show employment growth. As the area continues to expand beyond the oil and gas industry, there will be more growth in other sectors such as healthcare, education and professional services in both blue and white-collar services. This will further drive the demand for real estate, St. John says.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.