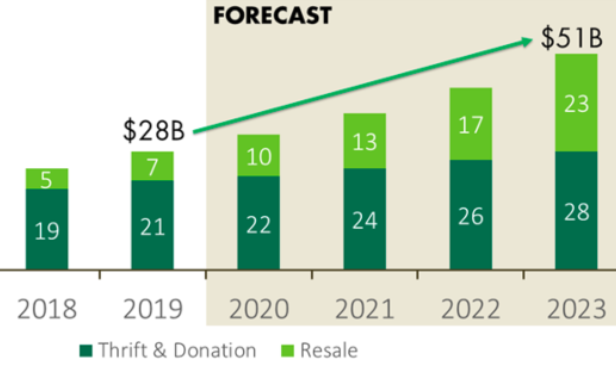

Second hand retailers are growing rapidly in Southern California. According to a new report from CBRE, thrift store and re-sell stores have increased square footage by 51% since 2010 in the region. Southern California, however, isn't alone. These retailers have been growing nationwide, with a total of $28 billion in 2019 alone, and an expectation that sales will double to $51 billion by 2023—barring of course any setbacks from the current corona virus pandemic.

Second hand retailers are growing rapidly in Southern California. According to a new report from CBRE, thrift store and re-sell stores have increased square footage by 51% since 2010 in the region. Southern California, however, isn't alone. These retailers have been growing nationwide, with a total of $28 billion in 2019 alone, and an expectation that sales will double to $51 billion by 2023—barring of course any setbacks from the current corona virus pandemic.

"From a retail perspective, this concept is gaining momentum due to the lack of pressure from e-commerce as well as the singular options that second-hand retailers offer," Motti Farag, senior associated at CBRE, tells GlobeSt.com. "Each individual second-hand retailer offers its own unique set of products, goods and apparel. Also, customers are often able to find great deals, which elevates their overall shopping experience. Shopping at second-hand retail stores is also experiential because of the excitement associated with finding an item that is truly one-of-a-kind in today's market. The lack of pressure from e-commerce is due to the low price points associated with the reused products that are found at a second-hand retailer."

The spectrum of re-sell brands can be expansive—from vintage and antique store to the Goodwill. In general, second hand stores include any stores that sell items that are used. "Second-hand apparel retailers are defined as a retail store which sells goods, primarily apparel, that are not brand new," says Farag. "The goods are purchased from individuals who are interested in selling or donating products and soft goods to retailers who can resell those items for reuse. Second-hand apparel gives customers the opportunity to recycle older items that they have outgrown or no longer need. Reuse is a virtuous cycle that reduces pollutants and waste build-up."

The most popular brands seeing the most rapid expansion in Southern California include Buffalo Exchange and Ecotown. "Goodwill is the most known name and has a large market presence," says Farag. "Buffalo Exchange is another company with stores across 20 states, and Ecotown is a company out of Japan that is looking to aggressively expand in the US. They have over 900 locations open in Japan and hope to have 300 stores in the United States by 2030."

These retailers are looking for locations with good visibility and parking, but even for owners with spaces that fit the mold, signing these tenants can be a challenge. "Landlords are facing challenges with older leases that restrict second-hand stores or thrift stores," says Farag. "However, in centers that allow for the use and depending on the co-tenancy, there is mutual interest, particularly in junior-sized anchor spaces, which are the more challenging sized spaces to lease."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.