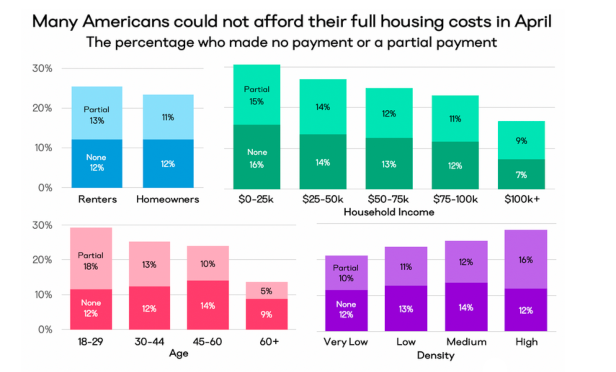

In April, 24% of apartment renters were unable pay rent. According to a report from Apartment List, one in four renters made either a partial rent payment or no rent payment at all. Additionally, the same number of homeowners—one in four—did not make their mortgage payment during the month of April.

In April, 24% of apartment renters were unable pay rent. According to a report from Apartment List, one in four renters made either a partial rent payment or no rent payment at all. Additionally, the same number of homeowners—one in four—did not make their mortgage payment during the month of April.

"Given the unprecedented spike in jobless claims this month, we knew a higher-than-average delinquency rate was coming in April—according to the American Housing Survey, in a typical month it's 3-4%—but a six-fold increase from that baseline is shocking, no matter what," Rob Warnock of Apartment List tells GlobeSt.com. "With many eviction/foreclosure moratoriums in place across the country, I think a lot of families may now be prioritizing other forms of essential spending knowing that their housing is secure even if they fall behind on payments."

Of the 24% of renters unable to pay rent, 12% were able to make a partial payment and the remaining 12% made no payment at all. In addition, one in nine renters asked their landlord to proactively lower their rent. Nearly half of renters overall are planning to use their stimulus check, which is nearly equal to the median rent for a two-bedroom apartment, to cover housing costs. "For many renters, the check is going to cover about one month of housing. It will certainly provide some short-term relief, but it is not going to be a long-term solution for families facing income loss," says Warnock. "In our survey we asked renters who didn't make a full April payment how confident they are in their ability to afford housing through June. Nearly half said "not so confident" or "not at all confident." So if shelter-in-place continues for several months, this is a problem that we expect to get worse before it gets better, even with this one-time stimulus payment."

Social distancing measures will likely continue through the end of April, at least. As a result, May rent delinquencies will likely be the same or increase. "It's looking less likely that the economy will reopen before May rent is due, so all else equal I would expect delinquency to stay high if not increase," says Warnock. "That said, the federal government is going to start issuing its stimulus payments throughout April, which will alleviate some of the pressure. It's difficult to say which of those competing forces will have a greater impact on May housing payments."

While the market is in a state of pause, moves are likely to come roaring back quickly once shelter-in-place restrictions are lifted. "When shelter-in-place gets lifted, moves will ramp back up but we expect a higher share will be downgrade moves, as impacted families look for cheaper housing in both the rental and for-sale markets," says Warnock. "This, unfortunately, may create greater competition for affordable housing and drive up prices at the cheaper-end of the market. On the luxury-side, we already saw high vacancy rates and landlords struggling to fill units before the coronavirus pandemic; this will only continue if upgrade moves get increasingly rare during an economic downturn."

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.