While you've no doubt heard about the Inflation Reduction Act (IRA), it may have evaded your sphere of concern as something only relevant to those focused on battling economic inflation or combating climate change. You may want to take a second look, though, as the bill has major considerations for the commercial real estate (CRE) industry. Since the bill is broad and its implications far-reaching, we will focus only on the bill's impacts to CRE and exclude consequences related to domestic manufacturing, single-family residences, medical costs, etc. If you are a commercial or multifamily property owner, property manager, developer, or investor in CRE, this article will be of particular interest to you.

The IRA (H.R. 5376) was signed into law by President Biden this past August, allocating $369 billion toward a myriad of strategies for reducing carbon emissions, with a particular focus on aiding poorer communities.

It's difficult not to notice the constant increase in electricity prices, which reached an all-time high in the first half of 2022 as a result of record high fossil fuel costs as well as inflation. Those in the CRE industry know that operational expenses can make or break a bottom line. The IRA aims to reduce these expenses by subsidizing both energy efficiency retrofits (to reduce total consumption) and renewable energy installations (to offset the cost of consumption). The bill primarily does this through tax deductions and credits.

Recommended For You

Energy Efficiencies

179D Tax Deduction

IRC Section 179D is an existing incentive which allows property owners and developers to claim a tax deduction on energy efficiency buildings and installations. The IRA enhanced this tax deduction by:

- Significantly increasing the $1.88/square foot deduction to a maximum deduction of $5.00/square foot.

- Significantly decreasing the minimum efficiency requirement to qualify for the tax deduction from 50% to 25%.

This deduction is applicable to all commercial buildings as well as multifamily buildings 4 stories and taller. Both existing buildings undergoing retrofits and new construction are eligible. Other updates to 179D include allowing REITs and tax-exempt building owners (ex. non-profits) to take advantage of these tax deductions, although in a limited capacity.

179D also allows real estate investors to deduct a significant portion of the cost of a new energy-efficient building, or a retrofit to an existing building, in the first year, as opposed to having to wait many years to realize those deductions as depreciation. Calculating the total amount of the first-year tax deduction can be complicated and requires that an independent engineer certify the energy savings target. An engineering consulting firm can design the energy efficiency improvements for the maximum tax deduction and ensure compliance to Section 179D and ASHRAE standards. Without going into the 'enthralling' details of the tax law, we can confidently say that many energy-efficiency projects which historically failed to "pencil out" will now be economically profitable.

45L Tax Credit

IRC Section 45L is a federal tax credit which incentivized developers of multifamily properties to meet energy efficient design criteria until its expiration in 2021. Developers received a tax credit of $2,000 for every energy efficient housing unit within their buildings. The IRA improved the tax credit by:

- Extending the 45L credit through 2032.

- Starting in 2023, the IRA will increase the maximum value of the tax credit from $2,000 to $5,000 per property for single family and multifamily homes.

In addition, the energy efficiency criteria will change to match the Department of Energy's (DOE's) programs which apply to all residential developments (as opposed to only low-rise developments). Multifamily properties 4 stories and up can be eligible for the 45L credits in addition to the 179D deductions.

Renewable Energy Generators

The IRA is more than just a tool for incentivizing the reduction of energy use; it also promotes the implementation of renewable energy generators like solar, and the technologies that support it like batteries and electric vehicles.

Solar

One of the biggest inclusions in the IRA is the extension of the solar investment tax credit (ITC) until 2034. This credit allows owners and investors in solar arrays to claim a 30% tax savings on the hard-cost budget of their project.

In layman's terms, the government will reimburse you for 30% of the cost of your solar project in the form of a tax credit. Without getting too deep into the tax benefits of the legislation, we'll note that the energy code also allows for the solar asset to be depreciated (under MACRS) using a 5-year recovery period and for the owner to expense the depreciable basis of the system using the bonus depreciation rules.

While a 30% tax credit already gives most CRE professionals the necessary push to get their solar project over the hump, the IRA also includes provisions to increase the tax credit even further. A 10% adder will be applied to the tax credit for projects installed in low-income communities (20% for qualified low-income residential buildings). Additional adders are available for projects using equipment manufactured in the U.S. and for projects located in an "energy community" (areas with significant employment related to coal and natural gas).

Just as for energy efficiency improvements, starting in 2023 tax-exempt property owners and investors (ex. non-profits and state/local governments) will be allowed to transfer their renewable energy tax credit to a third party. This change effectively enables these entities to sell their tax credits for cash.

If you have available roof space with 15 years or more of usable life and have high utility rates, a solar PV system could provide a reliable investment with great tax incentives. Experienced consultants can help you maximize all the available rebates and incentives and ensure that the project is sound from feasibility through implementation.

Energy Storage

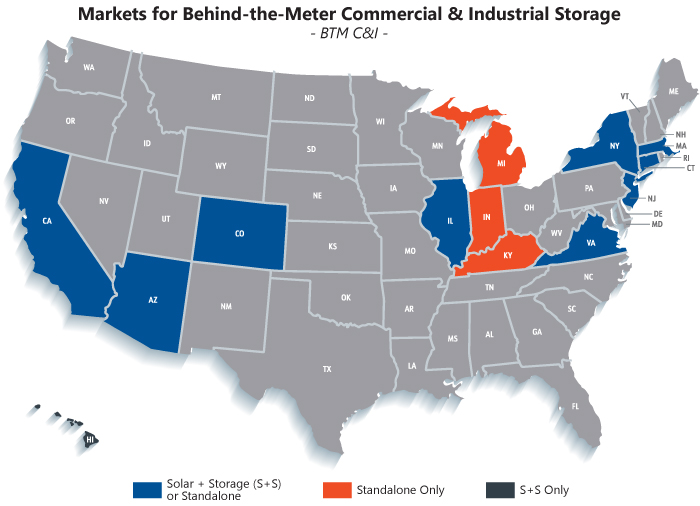

The IRA now considers energy storage or battery energy storage systems (BESS) to be a standalone project instead of having to be tied to a renewable energy project. This means that energy storage systems will be able to receive the same tax credit benefits and extensions as those mentioned in the solar section above. This is great news for all property owners currently owning or considering installing an energy storage system, especially properties with limited roof space. Pre-IRA, energy storage systems had to be charged by at least 75% for the first five years by renewable resources, which limited the possible services an energy storage system could provide and deterred property owners that could not install solar from installing an energy storage system. With the IRA, energy storage systems are now capable of offering a wider range of revenue streams than ever before. If a CRE property is located in any of the states below, an energy storage system will likely be a reliable investment with great tax incentives. Working with renewable energy consultants can allow you to quickly analyze these projects and provide detailed economic metrics for CRE clients that may be interested in an energy storage project.

.

Electric Vehicle Chargers

Property owners and investors interested in installing electric vehicle charging stations in their parking lots (or garages) in low-income or rural areas are now able to take advantage of the extended and modified Alternative Fuel Vehicle Refueling Property Credit. From 2023 through 2032, a 30% tax credit will be applied to this charging infrastructure up to $100,000 per item of property.

All above-mentioned project types that start in 2023 that are over 1 MWAC, however, must adhere to the IRA's prevailing wage and apprenticeship requirements; otherwise, the tax credits are reduced to 6%.

Conclusion

The direct financial benefits of the IRA discussed above are considerable and will go a long way toward incentivizing those in the CRE industry to incorporate renewable energy and energy efficiency systems into their business models. However, there are a variety of indirect and/or operational aspects of the IRA, which are beneficial to anyone whose business model requires attracting and keeping tenants. Lower electricity costs despite market volatility, energy supplied by onsite solar panels, protection from grid-outages, and the ability to charge electric vehicles are all major selling points for those whose business relies on keeping their buildings occupied.

And since the government is heavily subsidizing the cost of these improvements, now is a great time to take action.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.