BY THE NUMBERS

CHICAGO—Yardi Matrix just published stats on US industrial deals in the first half of 2017. And at the state-level, IL traded a larger number of square feet than CA – 3.7 million – but it's only the third most well-represented state after CA and NJ, with a total of $267 million invested in the first half-year. IL has four entries on its top 20 list, with a Chicago metro deal ranked at #9 – Brennan Investment Group's acquisition of Colony Realty's 30-property Chicagoland portfolio, which fetched $101 million. Bridge Development's sale of its Chicago, Lyons, Bartlett four-property portfolio landed at #11, Investcorp International Realty picked it up for $72 million in April; Bridge Development made the list again at #16 with PSP Capital Partners' acquisition of its three-building Aptakisic Creek Corporate Park in Buffalo Grove for $48 million.

NEWS & NOTABLES

CHICAGO, GREENWICH, CT—Officials from Starwood Capital Group, a global private real estate investment firm, announced yesterday that Michael P. Glimcher had just become chief executive officer of Chicago-based Starwood Retail Partners. Glimcher succeeds Scott Wolstein, who will transition to a new role as a senior advisor to Greenwich, CT-based Starwood Capital Group. “We are pleased to add an executive with Michael's deep expertise and high-caliber leadership ability to Starwood Retail Partners' team,” said Barry Sternlicht, chairman and chief executive officer of Starwood Capital Group and Starwood Property Trust. “His extensive industry experience and far-reaching relationships position him to step seamlessly into this role. Scott was a great partner who was essential to creating and growing Starwood Retail Partners from its inception in 2012 to a portfolio of 30 malls and lifestyle centers across the US.” A 27-year veteran of the real estate industry, Glimcher began his career with GlimcherRealty Trust, eventually serving as chief executive officer from 2005 to 2017 and as chairman from 2007 to 2015.

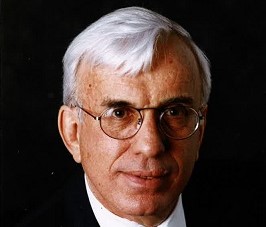

CHICAGO—One of Chicago's best known and most successful commercial real estate executives has joined Sterling Bay. Ron Frain, whose career spans 45 years in Chicago, will oversee the developer's newly formed industrial division, according to Sterling Bay managing principal Andy Gloor. It is a reunion for the duo –Frain launched Gloor's real estate career when he hired him out of college in 1994. “Ron was first boss and my mentor,” said Gloor. “I look back all those years and realize how incredibly fortunate I was to learn the business from a man who has accomplished so much.” Frain has formed three real estate development firms in Chicago, chalking up hundreds of millions of square feet in transactions along the way. He started his career at Gottlieb/Beale, and in 1972 he and the other principals formed Hawthorn Realty Group. In 1978, he co-founded Frain Camins & Swartchild, where he was chairman until the firm's 1997 sale to Insignia/ESG. Frain left Insignia/ESG in 2000 to co-found Bridge Development Partners LLC.

DEALTRACKER

OMAHA, NE—NorthMarq Capital has just acquired the operations of Daisely Ruff Financial Corp., a founding member of the Q10 network of commercial mortgage banking firms based in Omaha, NE. The acquisition makes the combined office the largest commercial mortgage banking firm in Omaha, based upon the number of producers, servicing portfolio and annual production volume. Daisley Ruff's co-founder Stephen Ruff will join Minneapolis-based NorthMarq as senior vice president/managing director. In addition, Bob Chalupa, a 30-year mortgage banking veteran, will join the company as senior vice president. “With their many long-term life company relationships and local and regional client base, the team at Daisley Ruff will be a great complement to NorthMarq Capital's life company relationships as well as our agency and CMBS sources,” said Jeffrey Weidell, president-NorthMarq Capital. The 25-year old firm, founded by Ruff and E.T. “Ding” Daisley, brings 25 life company correspondents and a servicing portfolio of $660 million to NorthMarq Capital.

DETROIT—Mid-America Real Estate Corp.'s investment sales team recently brokered the sale of Fairlane Green in Allen Park, MI, a Detroit suburb. The acquisition of the 95,490-square-foot shopping center was handled by Phoenix-based VEREIT on behalf of Cole Credit Property Trust V, Inc. Best Buy and LA Fitness anchor the property, and other tenants include Meijer and The Home Depot. Mid-America principals Joe Girardi and Ben Wineman in cooperation with Mid-America Real Estate – Michigan, Inc. associate Richard Kerwin were the brokers in the transaction on behalf of the seller, Lormax-Stern.

DETROIT—Mid-America Real Estate Corp.'s investment sales team recently brokered the sale of Fairlane Green in Allen Park, MI, a Detroit suburb. The acquisition of the 95,490-square-foot shopping center was handled by Phoenix-based VEREIT on behalf of Cole Credit Property Trust V, Inc. Best Buy and LA Fitness anchor the property, and other tenants include Meijer and The Home Depot. Mid-America principals Joe Girardi and Ben Wineman in cooperation with Mid-America Real Estate – Michigan, Inc. associate Richard Kerwin were the brokers in the transaction on behalf of the seller, Lormax-Stern.

CHICAGO—This city's Ford City Mall is undergoing a multimillion dollar renovation designed by Chicago-based OKW Architects and its operators just scored a top tenant. Hennes and Mauritz Inc., one of the world's largest fashion retailers, has agreed to occupy a 23,000 square-foot store set to open in the fall of 2018. According to Tracy Munno, general manager of Ford City, H&M, which offers affordable merchandise, is one of the retailers most requested by the mall's shopper base. “H&M is such a popular, dynamic brand, and the perfect fit for Ford City.” In 2017, H&M was the highest ranked fashion retailer on Forbes' best employers list and was named on Business of Fashion's list of best companies to work for in fashion.

BY THE NUMBERS

CHICAGO—Yardi Matrix just published stats on US industrial deals in the first half of 2017. And at the state-level, IL traded a larger number of square feet than CA – 3.7 million – but it's only the third most well-represented state after CA and NJ, with a total of $267 million invested in the first half-year. IL has four entries on its top 20 list, with a Chicago metro deal ranked at #9 – Brennan Investment Group's acquisition of Colony Realty's 30-property Chicagoland portfolio, which fetched $101 million. Bridge Development's sale of its Chicago, Lyons, Bartlett four-property portfolio landed at #11, Investcorp International Realty picked it up for $72 million in April; Bridge Development made the list again at #16 with PSP Capital Partners' acquisition of its three-building Aptakisic Creek Corporate Park in Buffalo Grove for $48 million.

NEWS & NOTABLES

CHICAGO, GREENWICH, CT—Officials from Starwood Capital Group, a global private real estate investment firm, announced yesterday that Michael P. Glimcher had just become chief executive officer of Chicago-based Starwood Retail Partners. Glimcher succeeds Scott Wolstein, who will transition to a new role as a senior advisor to Greenwich, CT-based Starwood Capital Group. “We are pleased to add an executive with Michael's deep expertise and high-caliber leadership ability to Starwood Retail Partners' team,” said Barry Sternlicht, chairman and chief executive officer of Starwood Capital Group and Starwood Property Trust. “His extensive industry experience and far-reaching relationships position him to step seamlessly into this role. Scott was a great partner who was essential to creating and growing Starwood Retail Partners from its inception in 2012 to a portfolio of 30 malls and lifestyle centers across the US.” A 27-year veteran of the real estate industry, Glimcher began his career with GlimcherRealty Trust, eventually serving as chief executive officer from 2005 to 2017 and as chairman from 2007 to 2015.

CHICAGO—One of Chicago's best known and most successful commercial real estate executives has joined Sterling Bay. Ron Frain, whose career spans 45 years in Chicago, will oversee the developer's newly formed industrial division, according to Sterling Bay managing principal Andy Gloor. It is a reunion for the duo –Frain launched Gloor's real estate career when he hired him out of college in 1994. “Ron was first boss and my mentor,” said Gloor. “I look back all those years and realize how incredibly fortunate I was to learn the business from a man who has accomplished so much.” Frain has formed three real estate development firms in Chicago, chalking up hundreds of millions of square feet in transactions along the way. He started his career at Gottlieb/Beale, and in 1972 he and the other principals formed Hawthorn Realty Group. In 1978, he co-founded Frain Camins & Swartchild, where he was chairman until the firm's 1997 sale to Insignia/ESG. Frain left Insignia/ESG in 2000 to co-found Bridge Development Partners LLC.

DEALTRACKER

OMAHA, NE—NorthMarq Capital has just acquired the operations of Daisely Ruff Financial Corp., a founding member of the Q10 network of commercial mortgage banking firms based in Omaha, NE. The acquisition makes the combined office the largest commercial mortgage banking firm in Omaha, based upon the number of producers, servicing portfolio and annual production volume. Daisley Ruff's co-founder Stephen Ruff will join Minneapolis-based NorthMarq as senior vice president/managing director. In addition, Bob Chalupa, a 30-year mortgage banking veteran, will join the company as senior vice president. “With their many long-term life company relationships and local and regional client base, the team at Daisley Ruff will be a great complement to NorthMarq Capital's life company relationships as well as our agency and CMBS sources,” said Jeffrey Weidell, president-NorthMarq Capital. The 25-year old firm, founded by Ruff and E.T. “Ding” Daisley, brings 25 life company correspondents and a servicing portfolio of $660 million to NorthMarq Capital.

DETROIT—Mid-America Real Estate Corp.'s investment sales team recently brokered the sale of Fairlane Green in Allen Park, MI, a Detroit suburb. The acquisition of the 95,490-square-foot shopping center was handled by Phoenix-based VEREIT on behalf of Cole Credit Property Trust V, Inc.

DETROIT—Mid-America Real Estate Corp.'s investment sales team recently brokered the sale of Fairlane Green in Allen Park, MI, a Detroit suburb. The acquisition of the 95,490-square-foot shopping center was handled by Phoenix-based VEREIT on behalf of Cole Credit Property Trust V, Inc.

CHICAGO—This city's Ford City Mall is undergoing a multimillion dollar renovation designed by Chicago-based OKW Architects and its operators just scored a top tenant. Hennes and Mauritz Inc., one of the world's largest fashion retailers, has agreed to occupy a 23,000 square-foot store set to open in the fall of 2018. According to Tracy Munno, general manager of Ford City, H&M, which offers affordable merchandise, is one of the retailers most requested by the mall's shopper base. “H&M is such a popular, dynamic brand, and the perfect fit for Ford City.” In 2017, H&M was the highest ranked fashion retailer on Forbes' best employers list and was named on Business of Fashion's list of best companies to work for in fashion.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.