WASHINGTON, DC–Newmark Knight Frank held its 2017 BenchMarks event last week. BenchMarks is an annual report authored by Greg Leisch, NKF's senior managing director of Market Research — an event that the Washington DC area's CRE community looks forward to each year. GlobeSt.com will be looking at the findings over the next few days.

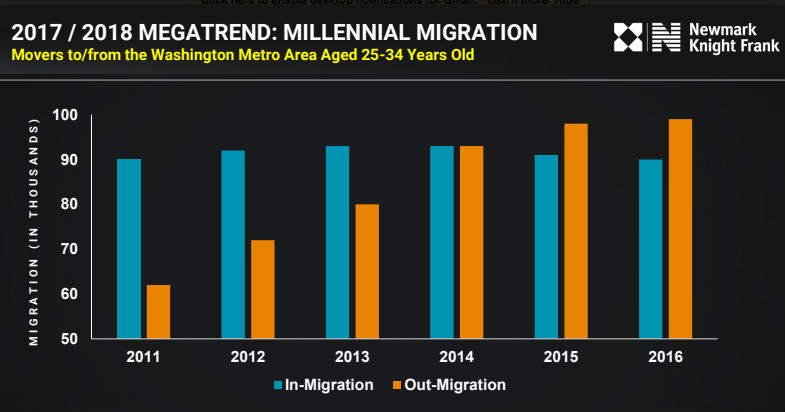

One finding is a bit sobering for the District: Millennials are starting to leave the city after flocking to it for years. This out-migration, Leisch tells GlobeSt.com, is increasing demand for office space and decreasing demand for apartments.

The out-migration started in 2015, Leisch says. “Prior to that, right through the Great Recession into the early part of recovery, we had this massive in-migration of millennials that fueled our hip restaurant scene, and our hip retail scene, and it fueled our booming apartment absorption. It also fueled the densification of office space because of the change in the population of our office tenancy.”

The data for 2017 isn't available yet but all evidence points to a continuation of this trend, he said.

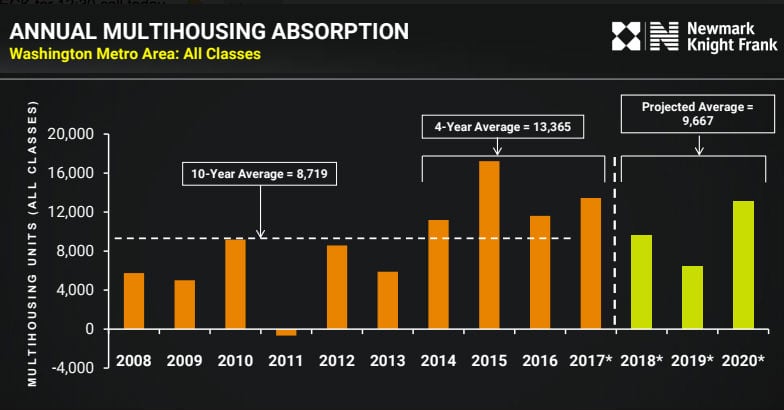

For apartments NKF is projecting somewhat of a drop in apartment demand.

Not all of that is due to the out-migration of Millennials, Leisch says — some of it is also due to slightly less employment growth in the period ahead.

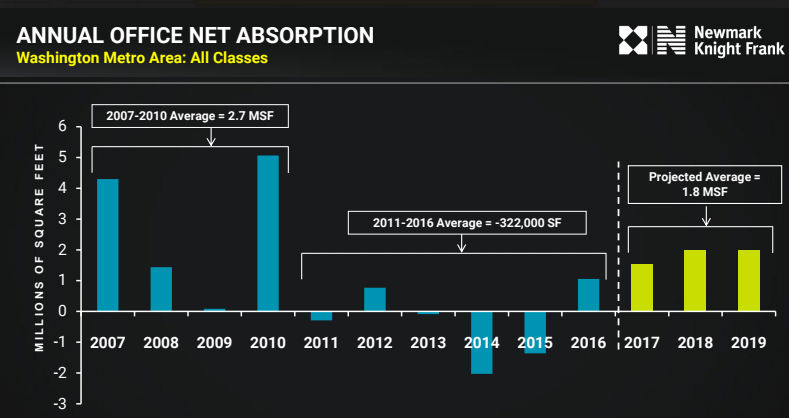

The office asset class, however, has begun to experience some absorption that started in 2016. Prior to that, from 2011-16, there was no office absorption, even though the area grew 240,000 jobs during that period. Leisch predicts that over the next three years office absorption will continue. Here too, the out-migration of Millennials is only partially a factor. “Office absorption, of course, is made up of a variety of factors, including employment growth and the types of jobs that are growing, but also significant is the demands and tastes of the office population,” he said. Millennials, in short, were never that keen on actually working in an office. Their preference was for telecommuting or collaborative space.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.