BY THE NUMBERS

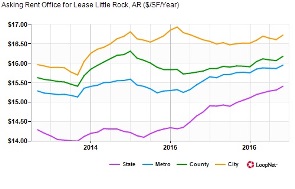

LITTLE ROCK, AR—The average asking rental rate per square foot per year for office properties as of mid-year was $16.72. This represents an increase of 0.2% compared to the prior three months, with an increase of 0.7% year-over-year. Countywide average rental rates are 0.4% higher at $16.18 per square foot per year for office properties currently for lease, according to LoopNet.

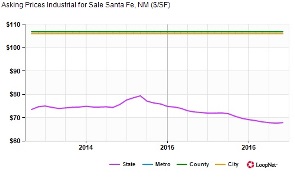

SANTA FE, NM—Current Santa Fe market trends data indicates no change in the median asking price per square foot for industrial properties compared to the prior three months, with no change compared to last year's prices. Countywide asking prices for industrial properties are similar to the current median asking price at $106 per square foot, according to LoopNet.

NEWS AND NOTABLES

DENVER—Mission Rock Residential LLC has received its Accredited Management Organization/AMO Accreditation by IREM. This accreditation is awarded to an elite group of property management firms that demonstrate the highest standards of professionalism, financial performance and ethics. Mission Rock Residential was formed by a group of real estate industry professionals who have extensive national property management experience. The firm's market knowledge, performance standards and operational strategies have afforded a substantial growth opportunity since its start in 2012.

DALLAS—KWA Construction volunteered at Dallas Animal Services and Adoption Center to help both human and furry friends prepare for an adoption event. KWA collected donations of towels, blankets, food and tasty treats. (Back row to front–Doug Robinson, assistant super; Chad Huffer, assistant project manager; Dee Nelson, project coordinator; Margie Brodeur, vice president of accounting; Charlie Bank, project coordinator; Christi Brownlow, business development coordinator; Yvonne Ayers, project coordinator; Jessica Medlin, human resources manager; Holly Webster, vice president of administration; Tasha Keene, office manager)

DALLAS—Brant Brown, Westmount Realty Capital chief financial officer has also been named chief operating officer. Brown, who joined Westmount in October 2015 as CFO, will broaden his focus to include companywide leadership and talent development, marketing, IT strategy and investment management.

DEAL TRACKER

DENVER—Marcus & Millichap announced the sale of Bellco Credit Union | Urgent Care Extra, a 6,448-square-foot retail property, according to Donald D. Morrow, regional manager of the firm's Phoenix office. The asset sold for $3.075 million. Jamie Medress, Mark Ruble and Chris Lind, investment specialists in Marcus & Millichap's Phoenix office, had the exclusive listing to market the property on behalf of the seller, a limited liability company. The buyer, a limited liability company, was secured and represented by Greg Price and Drew Isaac, investment specialists in Marcus & Millichap's Denver office. Bellco Credit Union | Urgent Care Extra is located at 3890 Quebec Square in Denver.

AUSTIN, TX—A 37-room hospitality property, Super 8 Austin Airport South, located at 3120 Montopolis Dr. has sold. Allan Miller and Chris Gomes, vice president investments in Marcus & Millichap's San Antonio and Dallas offices, had the exclusive listing to market the property on behalf of the seller, a partnership. The buyers, a limited liability company and private investor from New York, were also secured by Allan Miller. Michael Laurencelle, vice president capital markets, and Tom Laurencelle, associate in Marcus & Millichap Capital Corporation's Austin office, originated the loan.

DALLAS—ATC Transportation LLC leased 75,676 square feet at 12750 Perimeter Dr. Matt Dornak and Ryan Wolcott with Stream Realty Partners represented the landlord, DRA advisors. Hanes Chatham with Stream Realty Partners represented the tenant.

DALLAS—24/7 Customer Inc., leased 34,098 square feet at Gramercy Center South located at 18451 North Dallas Pkwy. Matt Wieser and Ryan Evanich with Stream Realty Partners represented the landlord, Capridge Partners. Site Selection Group LLC represented the tenant.

DALLAS—Capital Distributing Inc., extended its 31,000-square-foot lease at 9119 John Carpenter Freeway in Dallas. Jason Moser with Stream Realty Partners was the broker involved in the transaction.

ARLINGTON, TX—Howell Properties, LLC sold its 12,344-square-foot at 2901 Galleria Dr. to NP Arlington Industrial LLC. Matt Dornak and Luke Davis with Stream Realty Partners represented the seller and Coy E. Garrett & Associates Inc. represented the buyer.

IRVING, TX—BLJC PPTIES LLC sold its 7,000-square-foot building at 1720 Peters Rd. to Midnight Mechanics Inc. Henry S. Miller represented the seller and Hanes Chatham with Stream Realty Partners represented the buyer.

BUILDING BLOCKS

CONVENT, LA—Central Crossing and Convent Trace, two apartment communities will receive significant upgrades, thanks in part to grant funds totaling $462,000 from the Federal Home Loan Bank of Dallas (FHLB Dallas) and Home Federal Bank. The St. James Parish Housing Authority received a $252,000 Affordable Housing Program grant for Central Crossing and $210,000 for Convent Trace from the banks this year. The grants will be used for renovations to the two apartment complexes, including upgrades to finishes, new cabinets, appliances, doors, hardware, plumbing and electrical fixtures, heating and cooling systems, windows, and resident amenities. Central Crossing will also receive a new sewer treatment plant and repairs to two buildings that were damaged by a tornado in 2015. Renovations will begin in March 2017 and are expected to be completed in February 2018.

ELDORADO, AR—LSB Industries Inc. says it has resumed production of nitric acid at its chemical facility last week following the completion of a temporary nitrous oxide bypass system and the receipt of required permitting from state regulators. The work was completed to remedy a previously disclosed leak in the nitrous oxide abatement vessel of El Dorado's new nitric acid plant. As previously disclosed, the company plans to install a new permanent nitrous oxide abatement vessel that management anticipates will be completed in late 2017. In the meantime, the temporary solution is expected to enable El Dorado's nitric acid plant to operate at targeted capacity on an ongoing basis. During the nitric acid plant's recent downtime, customer orders were satisfied utilizing product shipped from LSB's other facilities with minimal financial impact. Expenses related to the construction of the temporary bypass system were recognized in the third and fourth quarters of 2016, which the company expects to recoup, along with costs related to the installation of the new nitrous oxide abatement vessel, under the warranty provisions of the original nitrous acid plant construction contract.

BY THE NUMBERS

LITTLE ROCK, AR—The average asking rental rate per square foot per year for office properties as of mid-year was $16.72. This represents an increase of 0.2% compared to the prior three months, with an increase of 0.7% year-over-year. Countywide average rental rates are 0.4% higher at $16.18 per square foot per year for office properties currently for lease, according to LoopNet.

SANTA FE, NM—Current Santa Fe market trends data indicates no change in the median asking price per square foot for industrial properties compared to the prior three months, with no change compared to last year's prices. Countywide asking prices for industrial properties are similar to the current median asking price at $106 per square foot, according to LoopNet.

NEWS AND NOTABLES

DENVER—Mission Rock Residential LLC has received its Accredited Management Organization/AMO Accreditation by IREM. This accreditation is awarded to an elite group of property management firms that demonstrate the highest standards of professionalism, financial performance and ethics. Mission Rock Residential was formed by a group of real estate industry professionals who have extensive national property management experience. The firm's market knowledge, performance standards and operational strategies have afforded a substantial growth opportunity since its start in 2012.

DALLAS—KWA Construction volunteered at Dallas Animal Services and Adoption Center to help both human and furry friends prepare for an adoption event. KWA collected donations of towels, blankets, food and tasty treats. (Back row to front–Doug Robinson, assistant super; Chad Huffer, assistant project manager; Dee Nelson, project coordinator; Margie Brodeur, vice president of accounting; Charlie Bank, project coordinator; Christi Brownlow, business development coordinator; Yvonne Ayers, project coordinator; Jessica Medlin, human resources manager; Holly Webster, vice president of administration; Tasha Keene, office manager)

DALLAS—Brant Brown, Westmount Realty Capital chief financial officer has also been named chief operating officer. Brown, who joined Westmount in October 2015 as CFO, will broaden his focus to include companywide leadership and talent development, marketing, IT strategy and investment management.

DEAL TRACKER

DENVER—Marcus & Millichap announced the sale of Bellco Credit Union | Urgent Care Extra, a 6,448-square-foot retail property, according to Donald D. Morrow, regional manager of the firm's Phoenix office. The asset sold for $3.075 million. Jamie Medress, Mark Ruble and Chris Lind, investment specialists in Marcus & Millichap's Phoenix office, had the exclusive listing to market the property on behalf of the seller, a limited liability company. The buyer, a limited liability company, was secured and represented by Greg Price and Drew Isaac, investment specialists in Marcus & Millichap's Denver office. Bellco Credit Union | Urgent Care Extra is located at 3890 Quebec Square in Denver.

AUSTIN, TX—A 37-room hospitality property, Super 8 Austin Airport South, located at 3120 Montopolis Dr. has sold. Allan Miller and Chris Gomes, vice president investments in Marcus & Millichap's San Antonio and Dallas offices, had the exclusive listing to market the property on behalf of the seller, a partnership. The buyers, a limited liability company and private investor from

DALLAS—ATC Transportation LLC leased 75,676 square feet at 12750 Perimeter Dr. Matt Dornak and Ryan Wolcott with Stream Realty Partners represented the landlord, DRA advisors. Hanes Chatham with Stream Realty Partners represented the tenant.

DALLAS—24/7 Customer Inc., leased 34,098 square feet at Gramercy Center South located at 18451 North Dallas Pkwy. Matt Wieser and Ryan Evanich with Stream Realty Partners represented the landlord, Capridge Partners. Site Selection Group LLC represented the tenant.

DALLAS—Capital Distributing Inc., extended its 31,000-square-foot lease at 9119 John Carpenter Freeway in Dallas. Jason Moser with Stream Realty Partners was the broker involved in the transaction.

ARLINGTON, TX—Howell Properties, LLC sold its 12,344-square-foot at 2901 Galleria Dr. to NP Arlington Industrial LLC. Matt Dornak and Luke Davis with Stream Realty Partners represented the seller and Coy E. Garrett & Associates Inc. represented the buyer.

IRVING, TX—BLJC PPTIES LLC sold its 7,000-square-foot building at 1720 Peters Rd. to Midnight Mechanics Inc. Henry S. Miller represented the seller and Hanes Chatham with Stream Realty Partners represented the buyer.

BUILDING BLOCKS

CONVENT, LA—Central Crossing and Convent Trace, two apartment communities will receive significant upgrades, thanks in part to grant funds totaling $462,000 from the Federal Home Loan Bank of Dallas (FHLB Dallas) and Home Federal Bank. The St. James Parish Housing Authority received a $252,000 Affordable Housing Program grant for Central Crossing and $210,000 for Convent Trace from the banks this year. The grants will be used for renovations to the two apartment complexes, including upgrades to finishes, new cabinets, appliances, doors, hardware, plumbing and electrical fixtures, heating and cooling systems, windows, and resident amenities. Central Crossing will also receive a new sewer treatment plant and repairs to two buildings that were damaged by a tornado in 2015. Renovations will begin in March 2017 and are expected to be completed in February 2018.

ELDORADO, AR—LSB Industries Inc. says it has resumed production of nitric acid at its chemical facility last week following the completion of a temporary nitrous oxide bypass system and the receipt of required permitting from state regulators. The work was completed to remedy a previously disclosed leak in the nitrous oxide abatement vessel of El Dorado's new nitric acid plant. As previously disclosed, the company plans to install a new permanent nitrous oxide abatement vessel that management anticipates will be completed in late 2017. In the meantime, the temporary solution is expected to enable El Dorado's nitric acid plant to operate at targeted capacity on an ongoing basis. During the nitric acid plant's recent downtime, customer orders were satisfied utilizing product shipped from LSB's other facilities with minimal financial impact. Expenses related to the construction of the temporary bypass system were recognized in the third and fourth quarters of 2016, which the company expects to recoup, along with costs related to the installation of the new nitrous oxide abatement vessel, under the warranty provisions of the original nitrous acid plant construction contract.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.