While national investors shied away from Houston because of the downturn in the oil industry, some look at it as an opportunity in disguise. Headlines this week tout the resilience of Houston, with investors and developers expressing their belief in the power of a comeback. Words such as diversified economy, underappreciated market, growth opportunity, value in Houston, great time to invest and layoffs have hit bottom are being used. And the sentiment seems to be shared in the data, with an increase of 7.5% in the median asking price per square foot for office properties compared to the prior three months, according to LoopNet. While this is less than the increase of 12.9% last year, the other sectors are following suit with increases, albeit at lower rates.—Lisa Brown

BY THE NUMBERS

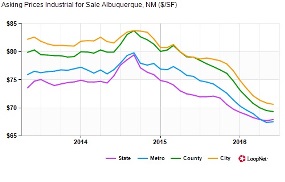

ALBUQUERQUE—Market trends data indicates a decrease of 2.1% in the median asking price per square feet for industrial properties compared to the prior three months, with a decrease of 10.6% compared to last year's prices, says LoopNet. Countywide asking prices for industrial properties are 2.1% lower at $69 per square foot compared to the current median price of $71 per square foot for industrial properties.

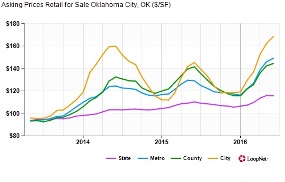

OKLAHOMA CITY—Current Oklahoma City market trends data indicates an increase of 23.2% in the median asking price per square foot for retail properties compared to the prior three months, with an increase of 15.8% compared to last year's prices, according to LoopNet. Countywide asking prices for retail properties are 15% higher at $144 per square foot compared to the current median price of $168 per square foot for retail properties.

NEWS AND NOTABLES

HOUSTON—Transwestern's Healthcare Advisory Services team has hired Matt Gilbert as vice president, expanding the country's largest dedicated healthcare real estate team to 22 members in Houston. Gilbert will provide tenant advisory, agency leasing and investment sales services to healthcare real estate occupiers, owners and investors. Gilbert has more than 20 years of experience in commercial real estate, 15 of which have been exclusively in the healthcare sector. He most recently served as vice president of leasing at Healthcare Trust of America, where he oversaw the leasing efforts for the firm's Texas medical office portfolio. His career has included small business ownership, leasing supervision of a 2 million-square-foot medical office portfolio and senior-level management positions.

DENVER—Holliday Fenoglio Fowler LP has expanded its investment sales team with the addition of Mark Williford and Chad Murray as associate directors in its Denver office. Williford and Murray will focus on retail commercial investment sale transactions throughout Colorado and the Greater Rocky Mountain region. Williford joins HFF from SullivanHayes Brokerage Corporation Inc., where he was a retail broker and participated in more than 500,000 square feet of transactions. Williford is a member of the International Council of Shopping Centers (ICSC), ICSC NextGen and the Urban Land Institute.

DEAL TRACKER

SAN ANTONIO—JLL announced the signing of 21,119 square feet of new office leases at Forum Offices during the past 60 days. The largest deal was with GM Financial, who will occupy the first floor of Forum Three office building for 10,661 square feet. Other new tenants include CoStar Group, Guardian Mortgage Company and HMG Engineers. JLL's team of Mark Krenger, Lisa Mittel, and Meredith Sheeder worked on behalf of the landlord, a partnership between Endeavor Real Estate and Long Wharf Partners to finalize the transactions. JLL's Pat McDowell and John Worthen represented GM Financial, Sergio Acosta of Cushman & Wakefield, San Antonio Commercial Advisors represented CoStar Group, and Scott Wolff with Transwestern represented Guardian Mortgage Company.

DENVER—HFF arranged $46.55 million in two separate financings for the Platte Street Portfolio, three class-A mixed-use assets and an adjacent office development site along Platte Street. HFF worked on behalf of the borrower, Unico Properties Inc., to secure the two three-year, floating-rate loans through a bank. Loan proceeds were used to refinance the three existing properties and provide construction financing for the office development. The three existing turn-of-the-century properties, 1537 Platte, Root Building and Zang Building, total 102,873 square feet and feature creative office space with wood beams and exposed ceilings along with ground floor retail.

BATON ROUGE, LA—365 Connect, a provider of marketing, leasing and resident technology platforms for the multifamily housing industry, will participate in the Baton Rouge Apartment Association Product and Services Trade Show. The conference takes place tomorrow. Providing technology solutions to multifamily housing communities across the nation, 365 Connect will demonstrate its resident lifecycle platform during the event.

DENVER—Natixis and Square Mile Capital provided $70 million of floating-rate financing to Columbia Sussex Corporation for the acquisition of the Hyatt Regency Denver Tech Center, a 451-room full-service hotel. Natixis provided a $56 million senior loan while Square Mile Capital provided a $14 million mezzanine loan. The funds were used to acquire the property and to fund a property improvement plan. The hotel is conveniently located four blocks from the Belleview light rail station and is in close proximity to the abundance of employers and retail amenities spread throughout the Denver Tech Center. The transaction was arranged by Rob Rubano of Eastdil Secured and was originated out of Square Mile Capital's New York office and Natixis' Los Angeles office.

BUILDING BLOCKS

LITTLE ROCK, AR—The Shops at University Village is a new grocery-anchored development in the heart of the Midtown Retail and Medical Districts at the NEC of Interstate 630 and South University Avenue. The area enjoys the densest daytime population in the state thanks to four hospitals, more than 1 million square feet of retail and more than 500,000 square feet of medical office space, all within 2 miles. The dense medical employment is also clear in the demographics with more than 40% of the surrounding households holding a bachelor's degree and average household incomes of slightly less than $60,000. Other nearby traffic drivers include the University of Arkansas at Little Rock, Arkansas Children's Hospital and Baptist Medical Center.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.