Here is a roundup of the latest leases, sales and other transactions in the Northeast middle markets.

This week by the numbers

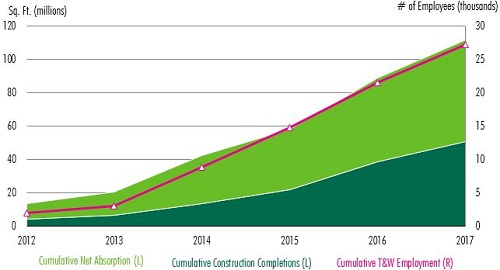

At the year's end, warehouses all around Pennsylvania's I-78/I-81 Corridor are swelling with extra employees and bustling with activity to satisfy holiday wish lists across the Northeast. The Corridor's enduringly strong industrial market performance transcends seasonality, however. In a new report from CBRE's Philadelphia office, research indicates that in 2017, 11.5 million square feet of warehouse space was absorbed, creating about 5,800 new transportation and warehousing jobs, and a 20-basis-point drop in fourth quarter warehouse vacancy to 6.6 percent, vs. 2016. While deliveries modestly exceeded absorption this year (11.8 million square feet delivered), looking at cumulative supply and demand over the past five years shows total net absorption to-date in the cycle still well outpaces new development, CBRE says.

The Lehigh Valley continued to fulfill occupier needs for modern warehouse space as one of the biggest development hubs in the nation, and produced new transportation and warehousing jobs at the fastest pace since 1993. This warehouse market is filed squarely in the “Nice” column on CRE Santa's list, CBRE declares.

Corridor Warehouse Supply & Demand, Transportation & Warehousing Employment Aggregates

*Source: CBRE Research, Moody's Analytics, 2017 (Harrisburg-Carlisle, Allentown-Bethlehem & Scranton-Wilkes Barre MSAs, seasonally adjusted employment data including forecast for Q4 2017).

In 2018, warehouse development will remain elevated, and considering forecasts from Moody's Analytics, Econometric Advisors, and CBRE Research's own projections, the real estate firm expects to see another year of annual positive absorption and transportation & warehousing employment growth, if at a moderating pace.

Deal Tracker Daily

FLORHAM PARK, NJ—BNH Associates has acquiried 300 Tice Boulevard, a class-A office property totaling approximately 240,000 square feet in Woodcliff Lake, NJ, from Mack-Calie Realty Corporation in a $28 million transaction brokered by Holliday Fenoglio Fowler. The HFF team of senior managing director Jose Cruz, managing director Kevin O'Hearn, senior directors Michael Oliver and Stephen Simonelli and director Marc Duval represented the seller, and procured the buyer in conjunction with Hudson Equities. The three-story property is 65-percent leased, including notable tenants such as KPMG and Volkswagen. Constructed in 1991 on 20 acres, the building features an attractive granite facade, four atriums including an impressive lobby, a full-service cafeteria with dining area, fitness center, walking path and covered parking.

ELMWOOD PARK, NJ—20 Bushes Lane LLC acquired a 15,700-square-foot industrial/flex building located at 20 Bushes Lane in Elmwood Park, NJ. NAI Hanson's Joshua Levering, SIOR, , and Nicholas DePaolera represented the seller, RN Foster Associates, in this transaction and the buyer was represented by NAI James E. Hanson's Andrew Somple, SIOR. Completely renovated in 2015, 20 Bushes Lane is a first-class flex building with recent improvements that included makeovers of utilities, roof, mechanicals and a complete interior renovation. 20 Bushes Lane is fully air-conditioned with two loading docks, each with heavy lift levelers and ample parking. The building is located with immediate access to I-80 and the Garden State Parkway. The buyer will use the facility to manufacture valves and regulators.

NEW YORK, NY—Knotel, an office real estate company that provides branded headquarters on flexible terms for growing businesses, is teaming up with Cogswell Lee, GLUCK+ and MCP President Street to turn 473 President Street into a mixed-use development that includes office, retail, community facility and parking. Knotel, which services established companies of 20-500 employees that have outgrown coworking, will anchor the office component. The entire project will span 130k-187k square feet in Gowanus depending on the community space tenants that sign on. The Partnership is currently working with several community based organizations to fill the balance of the space.

FRAMINGHAM, MA—Waterton, a U.S. real estate investment and management company, has completed a $2 million renovation of the Sheraton Framingham Hotel & Conference Center, a 375-key hotel in Framingham, MA. The renovation updated guest rooms with new window treatments, furnishings and televisions in addition to common areas and amenity spaces, including the Sheraton Club lounge. The entire wireless network was also enhanced with over 130 new access points and upgraded bandwidth capacities. Waterton has owned and operated the Sheraton Framingham since 2011.

NEW YORK, NY—Thor Equities acquired the James New York hotel in Manhattan. Jones Lang LaSalle arranged the sale and secured the acquisition financing, which Natixis provided. International director Jeffrey Davis and managing director Gilda Perez-Alvarado led the JLL team on the sale. Managing director Kevin Davis and vice president Barnett Wu led the JLL team on the financing. The James New York hotel features 114 guestrooms, the Urban Garden, a multi-tiered outdoor space for dining and events, and The James Club, an all-glass space that overlooks the Urban Garden and neighboring sculpture garden.

UNION CITY, NJ—Weiss Realty, headquartered in Moonachie, NJ, arranged two lease transactions for 16,025 square feet of medical offices with an aggregate rental of $5.5 million at Kennedy Medical Center, 3196 Kennedy Boulevard in Union City. Sanitas of New Jersey, an independent health care organization with specialized healthcare services and urgent care clinics, has signed a 12-year lease for 14,375 square feet on the main level of the four-story art deco building. Rheumatology Associates of North Jersey has leased 1,650 square feet on the second floor for five years.

PHILADELPHIA, PA—In the largest new CBD Lease of 2017, Jefferson Health signed a 237,000-square-foot lease to anchor 1101 Market Street, which will be renamed as Jefferson Tower. Savills Studley negotiated the deal. Following mergers with Abington Health, Aria Health, Kennedy Health System and Philadelphia University, and completion of its overall Master Plan, Jefferson will unify the enterprise's corporate services in the new headquarters facility. Upon initial occupancy, Jefferson will occupy 40 percent of Jefferson Tower at the top of the building with the option for substantial expansion over time. The landlord of Jefferson Tower, Girard Estate, will renovate the lobby, add a direct connection to the Jefferson Station concourse and replace the building's signage with Jefferson signage. Savills Studley's senior vice president and Philadelphia branch manager Hether Smith, corporate managing director Cathy Pullen and managing director Jay Joyce represented Jefferson in the transaction. Joshua Sloan, David Healy and Alex Breitmayer of Jones Lang LaSalle represented the landlord.

PITTSBURGH, PA—High Street Residential and Northwestern Mutual have begun construction on Glasshouse, a five-story, class-A residential mixed-use building featuring 319 apartments—including studio, one-, one+den and two-bedroom units ranging in size from 665-to-1,200 square feet — with ground floor restaurant retail space and 335 indoor parking spaces. Glasshouse is located on the site of Pittsburgh's historic and prolific glassmaking factories, on the bank of the Monongahela River, overlooking Pittsburgh's “Golden Triangle” Central Business District. The project will be ready for occupancy in summer 2019.

Money Moves

HOBOKEN, NJ—Atlantic Environmental Solutions Inc. named Christopher Finley, LSRP, a vice-president. Finley brings more than 26 years of diverse industry experience to his new role, including broad-based strategic environmental liability planning and management applied to complex remediation projects and environmental portfolios in New Jersey and throughout the United States. Before joining AESI, Finley spent 16 years as founding partner/president of NewFields Princeton, a firm specializing in data analytics, environmental sciences and permitting, remediation design, construction and program management, and litigation support. He earned a bachelor's degree in civil engineer technology from Rochester Institute of Technology, and is a licensed site remediation professional.

NEW YORK, NY—Co-living leader Common has closed a $40 million Series C funding round led by Norwest Venture Partners. This brings Common's total funding raised to $63.35 million over the past three years. Jeff Crowe, managing partner at Norwest Venture Partners, has also joined Common's board of directors. The funding will be used to continue Common's expansion in new and existing markets and meet the extreme demand for co-living. Across the country, young professionals are living in cities for longer and later into their lives, and co-living has emerged as their choice for a better, more flexible way to live with roommates in cities and access a built-in community. Common operates 14 homes across 4 markets (NYC, San Francisco and Oakland, Chicago, Washington, DC). In October, Harriman Capital, a new real estate private equity firm focused on multifamily innovation, announced a $15 million equity investment to develop four new co-living properties in New York City and Los Angeles, to be managed by Common. Common's $16 million Series B round in 2016 was led by investments from prominent real estate families, including Milstein, LeFrak, and Mack.

WOODCLIFF LAKE, NJ—Cushman & Wakefield served as the exclusive advisor to Capstone Realty Group in arranging $28.5 million of financing secured by 50 Tice Boulevard, Woodcliff Lake, NJ. The three-year, floating rate financing was provided by Blue Vista Finance. Built in 1984, the property totals 247,614 square feet and is currently 82-percent occupied with approximately 30 percent rolling in the near term. The property is leased to pharmaceutical, legal services, and financial services tenants. A Cushman & Wakefield Equity, Debt and Structured Finance team of John Alascio, Sridhar Vankayala and Andre Hass represented Capstone Realty Group in the transaction. The Cushman & Wakefield team worked alongside Rob Friedberg, Managing Principal of Capstone Realty Group, who managed the acquisition and investment in-house.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.